JTH

TSP Legend

- Reaction score

- 1,158

Re: PRE VS. POST IFT

No worries, I've been slowly getting tuned back into the markets, I wasn't buy & holding, just ignoring the carnage of my under-performance

I'm just taking some gains off the table, I'll regroup and be back in this month

Thanks JTH - You've been a "Buy and Hold" for a while and I admire that strategy.

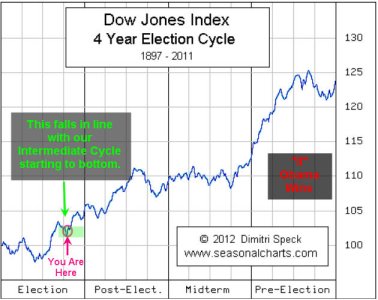

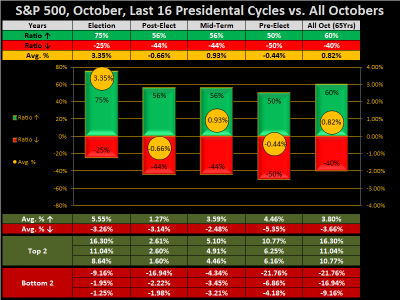

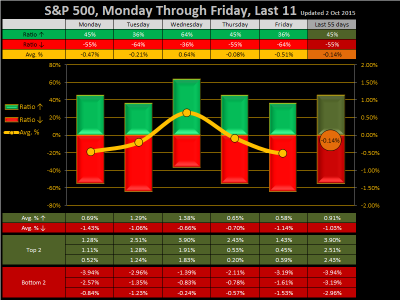

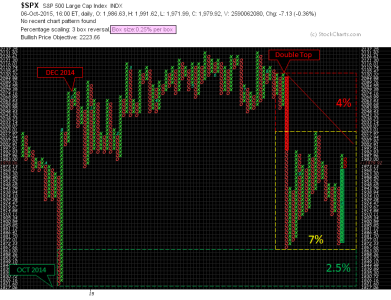

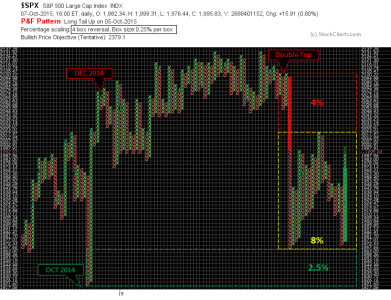

Serious question, do your charts indicate that this a good time of year for the buy and hold investor?

The first I have ever mentioned "Buy and Hold" and you eject to G Fund. It's like saying "Frau Blucher" in Young Frankenstein, just something one shouldn't say I suppose.

No worries, I've been slowly getting tuned back into the markets, I wasn't buy & holding, just ignoring the carnage of my under-performance

I'm just taking some gains off the table, I'll regroup and be back in this month