JTH

TSP Legend

- Reaction score

- 1,158

Your in the money today with your 100% C - I probably used my 2-3 lucky timing moves for year and now fear sets in, I'll freeze like Permafrost in the Arctic Circle while everyone else flys to the moon.

help me. :cheesy:

I don't think you need my help, you're doing just fine, much better than most folks

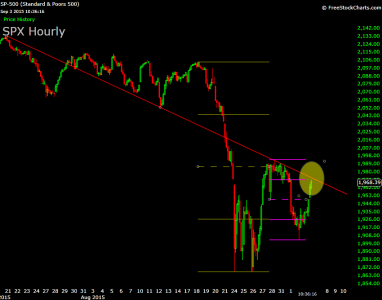

I'm watching for a test of the red trendline...