JTH

TSP Legend

- Reaction score

- 1,158

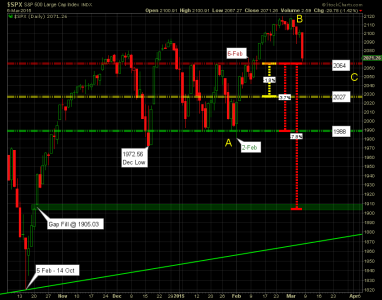

JTH, having breached 2085, and assuming SPX keeps going down, do you think that buying down in increments is a good entry strategy for the next upside?

The key levels I've been talking about in my blogs all week, are breached, now is a good time to sit on my hands, I'm not going to buy into a weakness under these specific conditions.

Also, I was stopped out of both my positions in DIG, was late to the game on that trade, so it didn't work out.