James48843

TSP Talk Royalty

- Reaction score

- 951

I saw this today- It’s from a newsletter on Facebook:

From:

Facebook

www.facebook.com

www.facebook.com

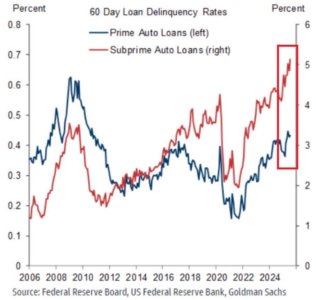

The car market bubble is bursting:

Subprime auto loan delinquency rates have now surpassed 5% for the first time in history.

The 60-day delinquency rate for subprime auto loans has more than DOUBLED over the last 3 years.

Delinquency rates are now ~1.5 percentage points above the 2008 Financial Crisis peak.

At the same time, prime auto loan delinquencies rose to their highest in 15 years.

Meanwhile, the total value of auto loans in the US jumped $13 billion, to a record $1.66 trillion in Q2 2025.

An auto debt crisis is brewing.

MORE than 5% delinquent on Auto subprime

From:

www.facebook.com

www.facebook.com

The car market bubble is bursting:

Subprime auto loan delinquency rates have now surpassed 5% for the first time in history.

The 60-day delinquency rate for subprime auto loans has more than DOUBLED over the last 3 years.

Delinquency rates are now ~1.5 percentage points above the 2008 Financial Crisis peak.

At the same time, prime auto loan delinquencies rose to their highest in 15 years.

Meanwhile, the total value of auto loans in the US jumped $13 billion, to a record $1.66 trillion in Q2 2025.

An auto debt crisis is brewing.

MORE than 5% delinquent on Auto subprime