Winter just can't get here fast enough for the bears. They need to go into hibernation in a bad way.

It's really been something to watch. The worst month of the year and we're still rallying. Sell in May? Not this year. No way Jose. That strategy certainly wasn't in play in this year.

The I fund may be lagging right now, but if you're spread out into C and/or S you're probably still moving higher. And the I fund may play catch up all at once with a dip on the dollar.

And after another day of gains you can bet the Seven Sentinels aren't looking bearish either.

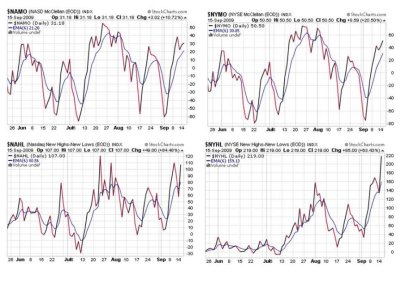

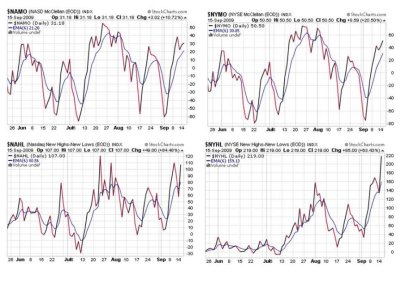

NAMO, NYMO, NAHL, and NYHL all flashing buy signals.

TRIN is back to a sell and TRINQ is close to a sell too, but BPCOMPQ has moved higher still and is poised to move above the upper bollinger band.

So no change to the system. Long and strong is still the way to go. And our top 25% in the tracker have not wavered either. They remain bullish on stocks.

It's really been something to watch. The worst month of the year and we're still rallying. Sell in May? Not this year. No way Jose. That strategy certainly wasn't in play in this year.

The I fund may be lagging right now, but if you're spread out into C and/or S you're probably still moving higher. And the I fund may play catch up all at once with a dip on the dollar.

And after another day of gains you can bet the Seven Sentinels aren't looking bearish either.

NAMO, NYMO, NAHL, and NYHL all flashing buy signals.

TRIN is back to a sell and TRINQ is close to a sell too, but BPCOMPQ has moved higher still and is poised to move above the upper bollinger band.

So no change to the system. Long and strong is still the way to go. And our top 25% in the tracker have not wavered either. They remain bullish on stocks.