Yesterday, the title of my blog was "Another Look Over the Precipice", and in that blog I had said that there were several instances when the market looked ready to roll over, but that market forces would seemingly step in and not only prop it up, but propel it. True, the charts didn't look as bad as some previous sessions in months past, but they still looked like they might roll over none-the-less. True to form though, the market would have none of that and rallied most of the day today.

We didn't gap and go like so many other reversals, stocks started the day in the red after some mixed market data, but found its footing after the Philadelphia Fed surprised to the upside. But did the market really need a reason to rally? It's seems to be baked in the cake at this point.

Bonds managed to rally today, while the dollar dipped slightly.

Today's action was not nearly as dramatic as past reversals, so I won't read too much into it at this point as the charts only look modestly better in some respects, while still suggesting more weakness in others. Here they are:

Back to buys for NAMO and NYMO, but not by much.

Still on sells for NAHL and NYHL, but here too it's not by much.

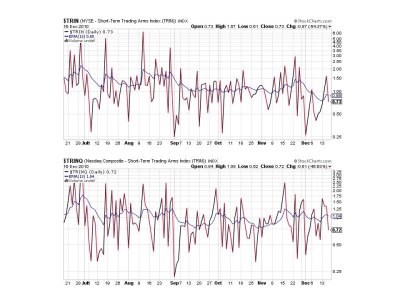

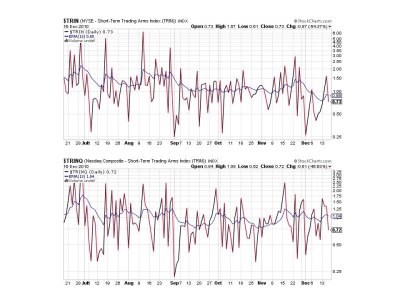

TRIN and TRINQ both flipped back to buys today.

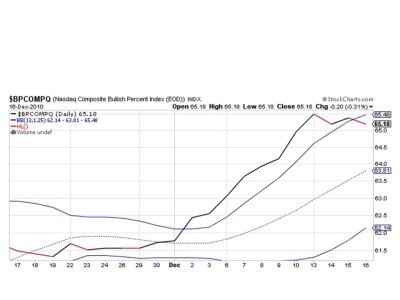

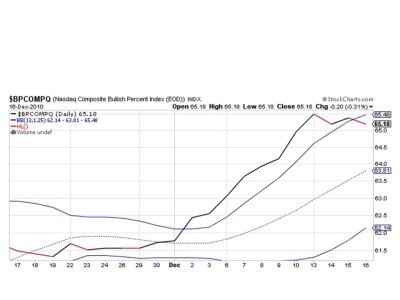

Yesterday BPCOMPQ rose on weakness. Today it dips on strength. And that suggests more weakness may be near, but I'm hardly confident of that outcome. At this point, I may take a modest position in stocks and just take my chances on a very accommodative Fed and seasonality.

We didn't gap and go like so many other reversals, stocks started the day in the red after some mixed market data, but found its footing after the Philadelphia Fed surprised to the upside. But did the market really need a reason to rally? It's seems to be baked in the cake at this point.

Bonds managed to rally today, while the dollar dipped slightly.

Today's action was not nearly as dramatic as past reversals, so I won't read too much into it at this point as the charts only look modestly better in some respects, while still suggesting more weakness in others. Here they are:

Back to buys for NAMO and NYMO, but not by much.

Still on sells for NAHL and NYHL, but here too it's not by much.

TRIN and TRINQ both flipped back to buys today.

Yesterday BPCOMPQ rose on weakness. Today it dips on strength. And that suggests more weakness may be near, but I'm hardly confident of that outcome. At this point, I may take a modest position in stocks and just take my chances on a very accommodative Fed and seasonality.