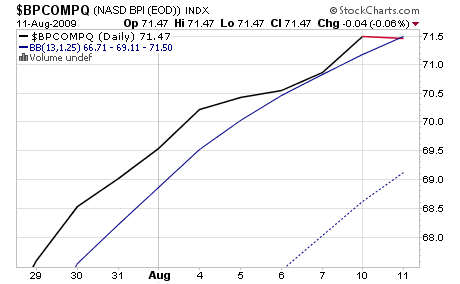

We have a sell on Seven Sentinels. All seven are in sell mode simultaneously. The only chart that I had to zoom in on, as expected, was $BPCOMPQ.

Here's the chart:

Just barely, but it's a sell.

I can simply exit the market tomorrow and not worry about a bounce or I can hold and hope.

Tomorrow's especially difficult due to the afternoon announcement by the FOMC, which could move the market, but occurs well after our cut-off for an IFT.

I could also go partially to G and simply cut risk and hope for a bounce.

But that's not playing by the indicators. And for me I'm suppose to exit when I receive a SS sell signal. This is probably what I'll do tomorrow and let the chips fall where they may.

Good luck to all.

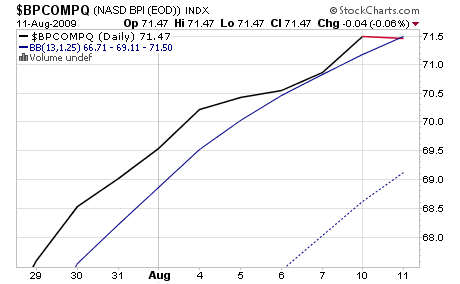

Here's the chart:

Just barely, but it's a sell.

I can simply exit the market tomorrow and not worry about a bounce or I can hold and hope.

Tomorrow's especially difficult due to the afternoon announcement by the FOMC, which could move the market, but occurs well after our cut-off for an IFT.

I could also go partially to G and simply cut risk and hope for a bounce.

But that's not playing by the indicators. And for me I'm suppose to exit when I receive a SS sell signal. This is probably what I'll do tomorrow and let the chips fall where they may.

Good luck to all.