Yesterday's Blog title was "Something's Gotta Give". Well as if you didn't already know, it gave.

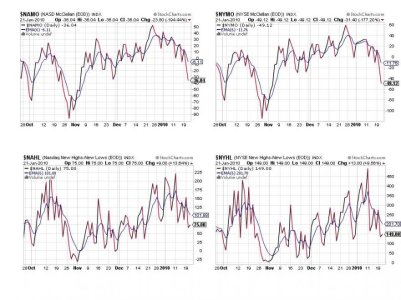

As I had suspected the market finally had some impressive downside follow-through. The downward slope of NAMO and NYMO as well as some nested buy/sell signals from the Seven Sentinels finally bore some fruit for the fence sitters, or those looking for the next opportunity to buy lower. Of course we don't know yet how long this move lower will last or how deep it will go, but it's an opportunity just the same for those with IFTs and cash in hand.

The news of the day included threats of tighter monetary policy in China due to stronger than expected 4th QTR GDP growth and increased bank regulation at home (a serious issue considering how the high flyers have rallied these past months). Those two issues have been a drag on the market for the last two trading days.

The Dollar was up again, which pounded the I fund and oil was down in spite of a higher than expected draw on stockpiles.

The Volatility Index closed about 19% higher today, the largest move in two months.

I had mentioned on the message board today that volume appeared higher than normal intraday and at the close the NYSE topped 1.5 billion shares, which was well above average and reason for some measure of caution moving foward.

Of the two data releases I mentioned yesterday (Initial Claims) was higher than expected, while continuing claims generally matched the forecast.

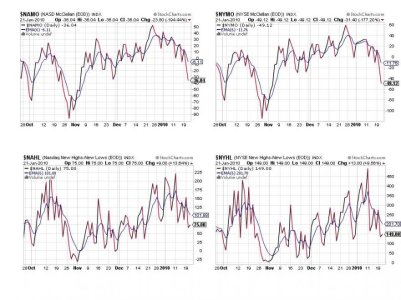

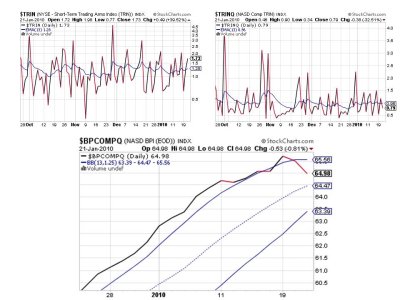

It should come as no surprise today that the Seven Sentinels remained in a sell condition. Here's the charts:

All four on sell here, but there's room to go lower.

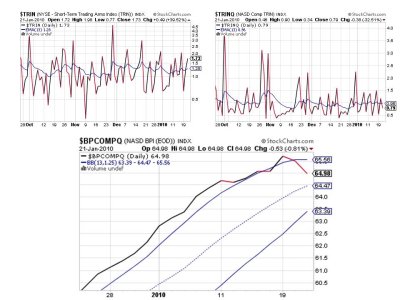

Two sells and one buy, with TRINQ the lone buy signal.

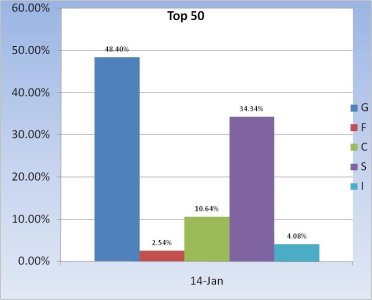

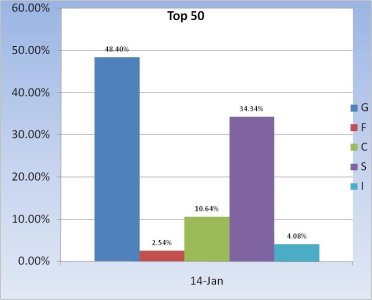

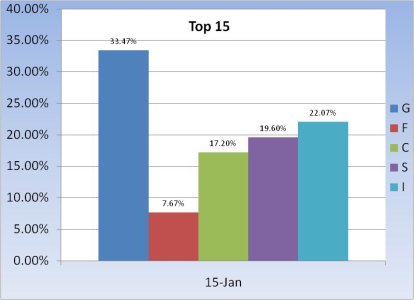

Our Top 50 did a big about face as expected with lily padders taking positions among the short term elite. Obviously the I fund has little representation here as dollar strength has really slammed that fund the past two days.

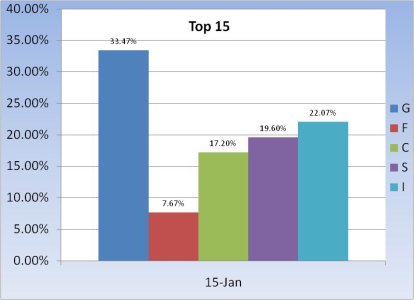

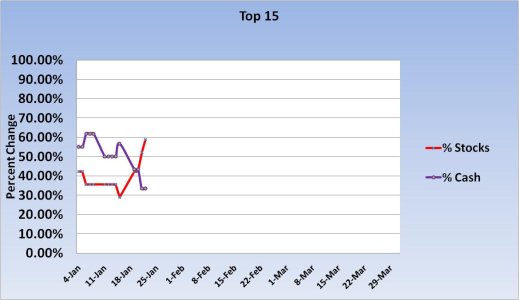

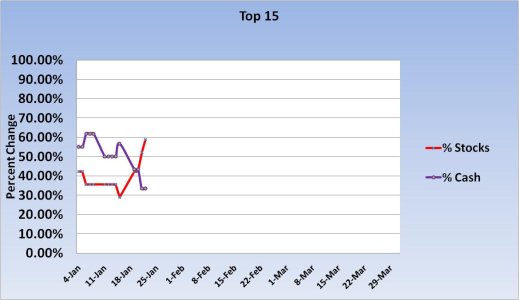

Our Top 15 moved a bit more cash into stocks today for tomorrow's trading action, but they collectively have some cash in reserve if we head lower still.

So the Seven Sentinels remain on a sell. SPX is sitting just over the 50 DMA, as pointed out on the message board today. If we drop below that it could get ugly fast. Otherwise the next rally may be right around the corner.

I am expecting more weakness, but I'm not expecting it to get ugly. If we have another day tomorrow like we had today, I may take a position in stocks. But Monday looms as a big question mark. Will this Monday be another big rally like so many others these past few months? If market character is changing that may not be the case this time. Something to consider for the moment.

That's it for this evening. See you tomorrow.

As I had suspected the market finally had some impressive downside follow-through. The downward slope of NAMO and NYMO as well as some nested buy/sell signals from the Seven Sentinels finally bore some fruit for the fence sitters, or those looking for the next opportunity to buy lower. Of course we don't know yet how long this move lower will last or how deep it will go, but it's an opportunity just the same for those with IFTs and cash in hand.

The news of the day included threats of tighter monetary policy in China due to stronger than expected 4th QTR GDP growth and increased bank regulation at home (a serious issue considering how the high flyers have rallied these past months). Those two issues have been a drag on the market for the last two trading days.

The Dollar was up again, which pounded the I fund and oil was down in spite of a higher than expected draw on stockpiles.

The Volatility Index closed about 19% higher today, the largest move in two months.

I had mentioned on the message board today that volume appeared higher than normal intraday and at the close the NYSE topped 1.5 billion shares, which was well above average and reason for some measure of caution moving foward.

Of the two data releases I mentioned yesterday (Initial Claims) was higher than expected, while continuing claims generally matched the forecast.

It should come as no surprise today that the Seven Sentinels remained in a sell condition. Here's the charts:

All four on sell here, but there's room to go lower.

Two sells and one buy, with TRINQ the lone buy signal.

Our Top 50 did a big about face as expected with lily padders taking positions among the short term elite. Obviously the I fund has little representation here as dollar strength has really slammed that fund the past two days.

Our Top 15 moved a bit more cash into stocks today for tomorrow's trading action, but they collectively have some cash in reserve if we head lower still.

So the Seven Sentinels remain on a sell. SPX is sitting just over the 50 DMA, as pointed out on the message board today. If we drop below that it could get ugly fast. Otherwise the next rally may be right around the corner.

I am expecting more weakness, but I'm not expecting it to get ugly. If we have another day tomorrow like we had today, I may take a position in stocks. But Monday looms as a big question mark. Will this Monday be another big rally like so many others these past few months? If market character is changing that may not be the case this time. Something to consider for the moment.

That's it for this evening. See you tomorrow.