Friday, the S&P closed with a moderate loss, but held support at 1335. Today, that support failed as the S&P closed at 1329.47 for a moderate loss of 0.62%. The Wilshire 4500 closed deeper at 1.18%, while the Nasdaq fell deeper still at 1.63%. By comparison, the DOW only dropped 0.38%.

Trading began on a negative note, but the market began bouncing almost immediately. Within about an hour stocks crossed back into positive territory, except for the Nasdaq, which was mired in the red all day. But even the other averages couldn't hold positive gains as the highs of the day were hit shortly after 1100 EST. From there, the market chopped its way lower finishing at or near the lows of the day.

It seems last week's negative tone has carried over into the new week. Perhaps the fact that the U.S. dept ceiling was hit today (with little indication that Congress will raise it) is prompting more profit taking as politics seems to be trumping economics right now. The market doesn't like unknowns, and that's a big unknown, which could have big consequences depending on how it plays out. So the Risk On, Risk Off trade looks to be in play.

So is it different this time? Can the market's resilience overcome all the negativity yet again?

It's a tough call. There's certainly no shortage of alarm bells going off, but that's not usually the environment I would expect a correction to occur in. We do have those gaps in the major averages that need to be filled. And the bears will be looking at those as the next target of a possible sustained decline. It's certainly not looking bullish right now. But that's when this market has shown a propensity for reversals.

Let's look at the charts:

NAMO and NYMO have dropped well into negative territory after today. Certainly we can go lower, but we can also bounce from these levels. Both are currently in a sell condition.

NAHL and NYHL also dropped lower and are in sell conditions.

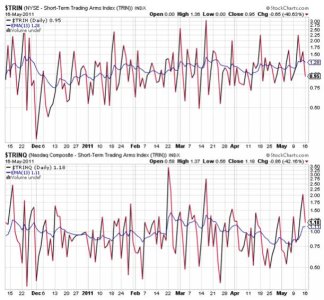

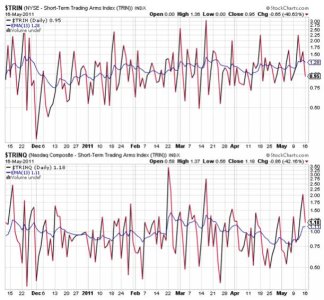

TRIN is flashing a buy, while TRINQ remains a sell.

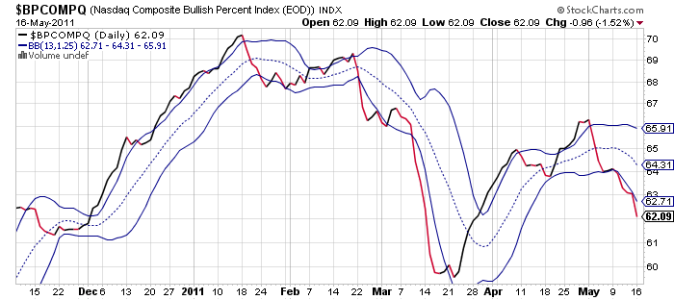

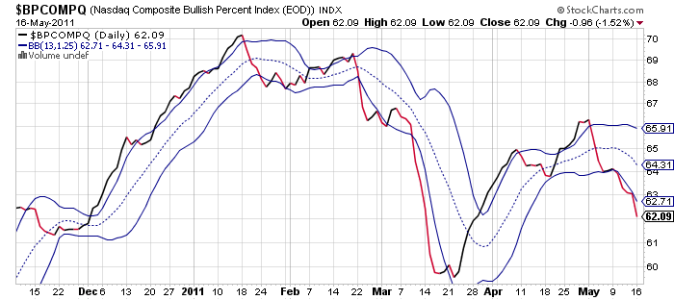

BPCOMPQ dropped hard and is really looking a bit ominous now. Of course it remains in a sell condition.

So all but one signal are flashing sells, which means the system still remains in a buy condition, but it's not far from a sell. And we've seen two unconfirmed sell signals in the past two weeks.

This market has rallied a long time on both good and bad news. And every time the market walked up to a precipice, it reversed. We may be looking at another one. Since this is OPEX I would expect to see a rally some time this week. Would it signal the next leg up, or would it be a selling opportunity before we continue lower?

There's many reasons to think an intermediate term correction has begun. QE2 is winding down, the dollar has begun rallying, our debt situation is hitting a political wall, and commodities have seen some serious selling pressure, to name a few. The game does seem to be changing. But we are also at a point where the market has so often put in a bottom and reversed.

That may happen yet again. But it may be time for those who are more risk averse to get defensive. Just in case it's different this time.

Trading began on a negative note, but the market began bouncing almost immediately. Within about an hour stocks crossed back into positive territory, except for the Nasdaq, which was mired in the red all day. But even the other averages couldn't hold positive gains as the highs of the day were hit shortly after 1100 EST. From there, the market chopped its way lower finishing at or near the lows of the day.

It seems last week's negative tone has carried over into the new week. Perhaps the fact that the U.S. dept ceiling was hit today (with little indication that Congress will raise it) is prompting more profit taking as politics seems to be trumping economics right now. The market doesn't like unknowns, and that's a big unknown, which could have big consequences depending on how it plays out. So the Risk On, Risk Off trade looks to be in play.

So is it different this time? Can the market's resilience overcome all the negativity yet again?

It's a tough call. There's certainly no shortage of alarm bells going off, but that's not usually the environment I would expect a correction to occur in. We do have those gaps in the major averages that need to be filled. And the bears will be looking at those as the next target of a possible sustained decline. It's certainly not looking bullish right now. But that's when this market has shown a propensity for reversals.

Let's look at the charts:

NAMO and NYMO have dropped well into negative territory after today. Certainly we can go lower, but we can also bounce from these levels. Both are currently in a sell condition.

NAHL and NYHL also dropped lower and are in sell conditions.

TRIN is flashing a buy, while TRINQ remains a sell.

BPCOMPQ dropped hard and is really looking a bit ominous now. Of course it remains in a sell condition.

So all but one signal are flashing sells, which means the system still remains in a buy condition, but it's not far from a sell. And we've seen two unconfirmed sell signals in the past two weeks.

This market has rallied a long time on both good and bad news. And every time the market walked up to a precipice, it reversed. We may be looking at another one. Since this is OPEX I would expect to see a rally some time this week. Would it signal the next leg up, or would it be a selling opportunity before we continue lower?

There's many reasons to think an intermediate term correction has begun. QE2 is winding down, the dollar has begun rallying, our debt situation is hitting a political wall, and commodities have seen some serious selling pressure, to name a few. The game does seem to be changing. But we are also at a point where the market has so often put in a bottom and reversed.

That may happen yet again. But it may be time for those who are more risk averse to get defensive. Just in case it's different this time.