The S&P is getting closer to resistance at the 1100 area, but did not make it there today. Another 1% higher and it'll hit the top of this channel. Then what? I certainly don't trust this market. Even if the S&P manages to get above resistance and close there, that doesn't mean a head fake might not be possible. And the volatility is punishing to us TSPers if we get on the wrong side of these trades. I still believe the flash crash we saw last month, along with this volatile action is a warning sign.

I'd prefer to wait until there is blood in the streets before I make another entry. As it is the Seven Sentinels did not trigger a buy signal today, but then technically it's still on a buy. I'm just not used to getting a buy signal and then see it immediately followed by 5% losses.

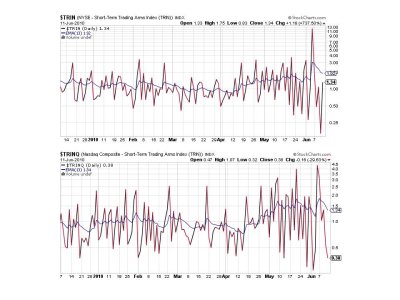

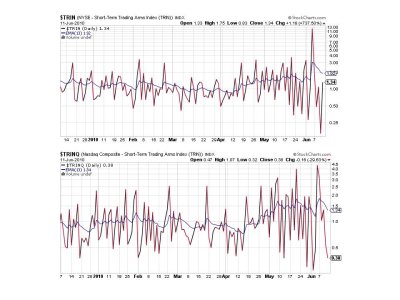

Here's the charts:

Looks good here, two buy signals. Highest levels we've seen in some time.

Two buys here too.

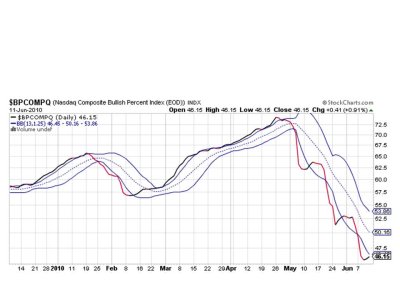

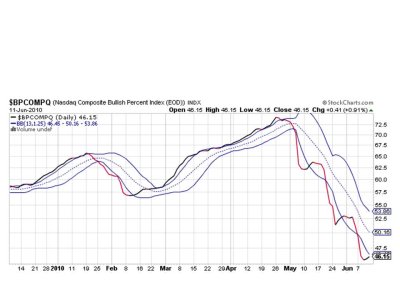

Two more buys.

BPCOMPQ remains on a sell, but is getting close to flipping to a buy.

The last two times this system triggered a buy I got punched in the mouth. To say the least that's frustrating. So I won't be buying this market on a buy signal in this volatility. I'd much prefer to see some blood and then jump in based on other indicators such as sentiment.

See you later this weekend.

I'd prefer to wait until there is blood in the streets before I make another entry. As it is the Seven Sentinels did not trigger a buy signal today, but then technically it's still on a buy. I'm just not used to getting a buy signal and then see it immediately followed by 5% losses.

Here's the charts:

Looks good here, two buy signals. Highest levels we've seen in some time.

Two buys here too.

Two more buys.

BPCOMPQ remains on a sell, but is getting close to flipping to a buy.

The last two times this system triggered a buy I got punched in the mouth. To say the least that's frustrating. So I won't be buying this market on a buy signal in this volatility. I'd much prefer to see some blood and then jump in based on other indicators such as sentiment.

See you later this weekend.