FireWeatherMet

Market Veteran

- Reaction score

- 247

- AutoTracker

One thing I remember vividly from the "Super Recession" of 2008-09 was how long many people stayed negative on stocks going into late 2009 into 2010 and even longer, while we were well into one of the strongest Bull Market runs in history. I suspect a lot had to do with the "Gloom & Doom" media, many of whom were preaching that some imaginary "Other Shoe" was about to fall.

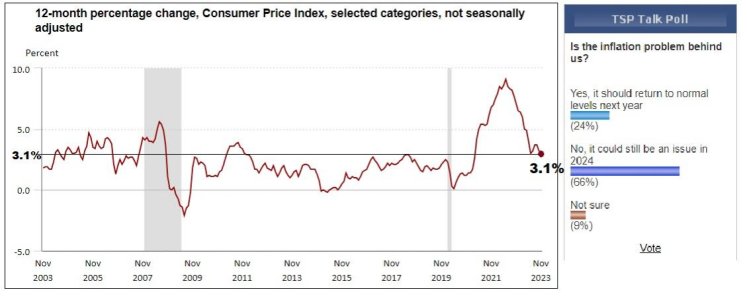

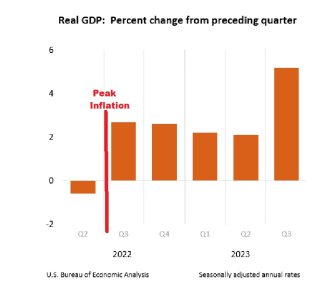

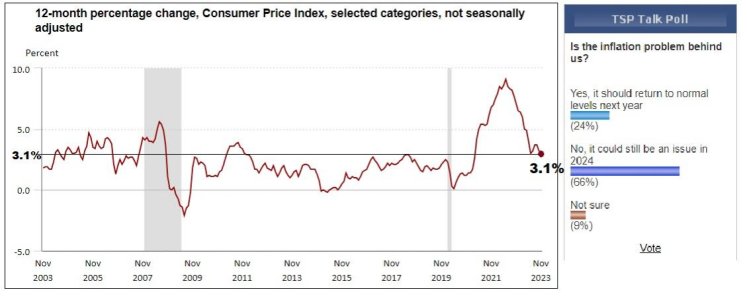

I see the same thing right now. Inflation and the Fed raising rates to fight it, has been the main drag on the market the past 2 years. But people seem too glued to the "Gloom & Doom" media, to understand the 2 main causes of the inflation...Post Pandemic Commerce/Supply Chain shortages...and OPEC/Russian Invasion Oil spike of 2021-22 have sorted themselves out and basically disappeared. Gas at the pumps, that was running $5.39 at my favorite local gas station is now all the way down to $2.69 and still falling. Inflation that peaked at 9.1% summer of 2022 is now all the way down to 3.1%, which is near the long term 20 year avg (see chart). The Fed is no longer hiking rates. Yet when you ask people, like in our poll, 2/3rds believe Inflation is still an issue :scratchchin: Sure there are lagging prices in grocery stores, but we're not paying $10 for a dozen eggs anymore. Used cars are no longer triple their Blue Book value, Median home prices are 10% lower than a year ago. Yet people are slow to react to current news, many live in the past, and are now missing out on a huge market uptick.

I'm actually missing out right now because I stepped aside last week, trying to catch the typical early Dec correction before getting back into equities, even that is looking like a bad move, as this stock market is relentless, esp small caps leading the way. Anyway, I thought our TSPTalk Survey and the reality of the data was interesting (Below).

I see the same thing right now. Inflation and the Fed raising rates to fight it, has been the main drag on the market the past 2 years. But people seem too glued to the "Gloom & Doom" media, to understand the 2 main causes of the inflation...Post Pandemic Commerce/Supply Chain shortages...and OPEC/Russian Invasion Oil spike of 2021-22 have sorted themselves out and basically disappeared. Gas at the pumps, that was running $5.39 at my favorite local gas station is now all the way down to $2.69 and still falling. Inflation that peaked at 9.1% summer of 2022 is now all the way down to 3.1%, which is near the long term 20 year avg (see chart). The Fed is no longer hiking rates. Yet when you ask people, like in our poll, 2/3rds believe Inflation is still an issue :scratchchin: Sure there are lagging prices in grocery stores, but we're not paying $10 for a dozen eggs anymore. Used cars are no longer triple their Blue Book value, Median home prices are 10% lower than a year ago. Yet people are slow to react to current news, many live in the past, and are now missing out on a huge market uptick.

I'm actually missing out right now because I stepped aside last week, trying to catch the typical early Dec correction before getting back into equities, even that is looking like a bad move, as this stock market is relentless, esp small caps leading the way. Anyway, I thought our TSPTalk Survey and the reality of the data was interesting (Below).