Stocks were hit early today, due to some surprisingly weak economic data. Initial jobless claims rose to 500K for last week, a number not seen since last November

And the Philadelphia Fed Index also provided a surprise with a reading of -7.7, which was much lower than the anticipated 7.5.

I had anticipated whipsaw action, and we pretty much saw that today.

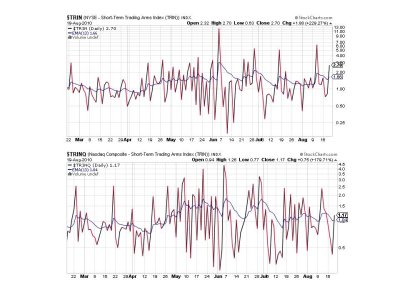

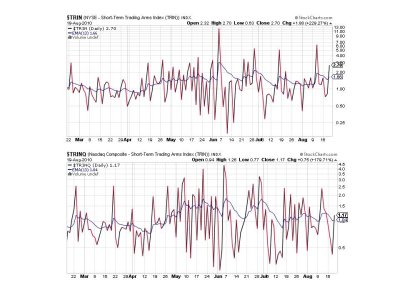

Here's the charts:

Sell.

Sell.

Sell.

BPCOMPQ is riding its lower bollinger band, but a turn down today has me seeing this signal as a sell, especially since yesterday's buy was largely neutral as it entered the bollinger band horizontally. That's 7 of 7 sells, which keeps the system on a sell.

My surgery went well, but I am in some measure of pain, so I'll cut this short again. The action continues to be uninspiring and because this is OPEX it can be misleading too. Not a good time to be taking unnecessarily risks on short term plays unless one really knows what they're doing.

See you tomorrow.

And the Philadelphia Fed Index also provided a surprise with a reading of -7.7, which was much lower than the anticipated 7.5.

I had anticipated whipsaw action, and we pretty much saw that today.

Here's the charts:

Sell.

Sell.

Sell.

BPCOMPQ is riding its lower bollinger band, but a turn down today has me seeing this signal as a sell, especially since yesterday's buy was largely neutral as it entered the bollinger band horizontally. That's 7 of 7 sells, which keeps the system on a sell.

My surgery went well, but I am in some measure of pain, so I'll cut this short again. The action continues to be uninspiring and because this is OPEX it can be misleading too. Not a good time to be taking unnecessarily risks on short term plays unless one really knows what they're doing.

See you tomorrow.