I mentioned yesterday that I didn't like the set-up for a potential Seven Sentinels buy signal. I said I wanted to give this market more time to prove things are getting bullish again and that I was not sure I'd follow a buy signal soon after a one-day rally.

Today the market was mixed, but still managed to advance in some pockets. It seems da boyz are not ready to take this market down. There is also the possibility that they want to allow the historically positive seasonal bias to take hold. We could see a rally this month and it's just possible it could be a good one. Bearishness still rises quickly and that continues to put a floor under this market.

So while I'm not particularly happy with the "set-up", I won't disregard a buy signal either. I mentioned this morning in my account thread that I was not going to front-run a potential buy signal, and I did say I thought we had a good chance to get one today, but I was concerned about the afternoon trading and simply wanted to see confirmation this time.

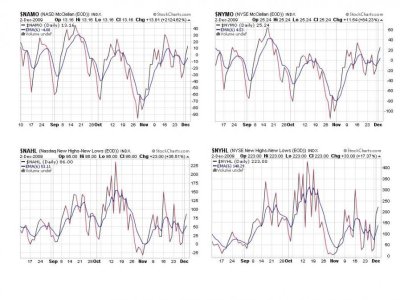

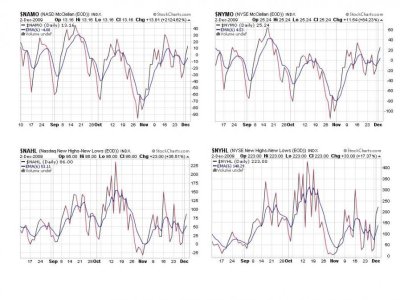

I got confirmation, and we got a Seven Sentinels buy signal. Here's the charts:

We remained on a buy in all four of these signals today.

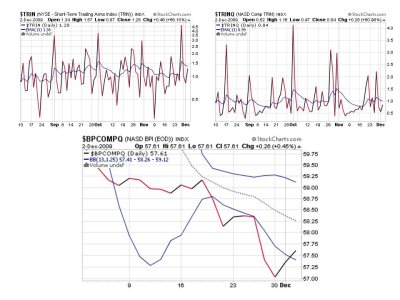

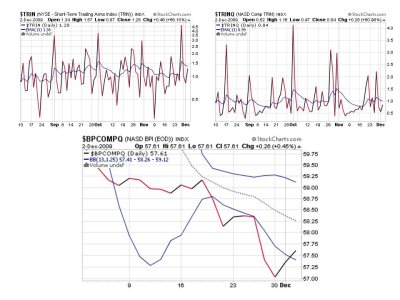

TRIN and TRINQ remained on a buy and BPCOMPQ actually pushed higher giving us an unquestionable buy signal.

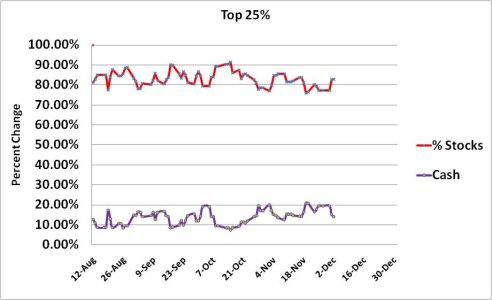

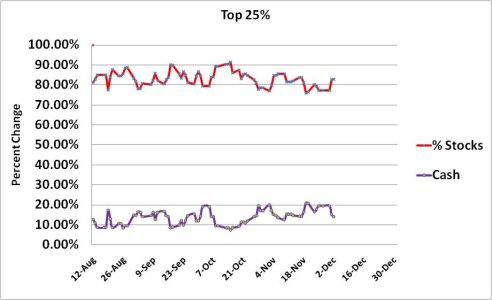

Our Top 25% have been loading up the past two days too. Cash levels have dropped over 5%.

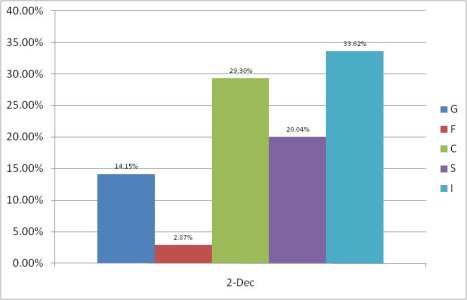

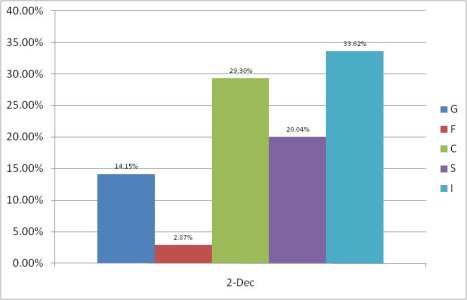

So we have 7 of 7 signals on a buy triggering a Seven Sentinels buy signal. So I'm going to enter the market tomorrow. The big question though is if this rally does happen will it be as fast as previous months or will it linger towards the end of the month or longer?

It matters, because seasonality is definitely on our side and this is the end of the 4th quarter. Sentiment certainly seems to be on our side too. And being it's the beginning of the month, there's a long time before new IFTs are available. These are things to keep in mind while watching for the next Seven Sentinels sell signal. For the moment I'm just doing a little pre-planning. We need to see how things play out now.

Today the market was mixed, but still managed to advance in some pockets. It seems da boyz are not ready to take this market down. There is also the possibility that they want to allow the historically positive seasonal bias to take hold. We could see a rally this month and it's just possible it could be a good one. Bearishness still rises quickly and that continues to put a floor under this market.

So while I'm not particularly happy with the "set-up", I won't disregard a buy signal either. I mentioned this morning in my account thread that I was not going to front-run a potential buy signal, and I did say I thought we had a good chance to get one today, but I was concerned about the afternoon trading and simply wanted to see confirmation this time.

I got confirmation, and we got a Seven Sentinels buy signal. Here's the charts:

We remained on a buy in all four of these signals today.

TRIN and TRINQ remained on a buy and BPCOMPQ actually pushed higher giving us an unquestionable buy signal.

Our Top 25% have been loading up the past two days too. Cash levels have dropped over 5%.

So we have 7 of 7 signals on a buy triggering a Seven Sentinels buy signal. So I'm going to enter the market tomorrow. The big question though is if this rally does happen will it be as fast as previous months or will it linger towards the end of the month or longer?

It matters, because seasonality is definitely on our side and this is the end of the 4th quarter. Sentiment certainly seems to be on our side too. And being it's the beginning of the month, there's a long time before new IFTs are available. These are things to keep in mind while watching for the next Seven Sentinels sell signal. For the moment I'm just doing a little pre-planning. We need to see how things play out now.