Well, we didn't really get any weakness today due to excessive bullishness in some pockets, and at this point even if it comes how much damage can it do? It is Options Expiration week, so we can certainly have some volatility as we move forward.

Tomorrow morning, three economic reports are scheduled to be released. Core PPI, PPI, and Empire Manufacturing. Wednesday we'll get Core CPI, CPI, and a FOMC announcement. So we have some potential market moving news coming. Here's today's charts:

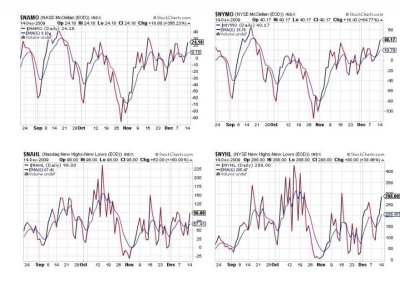

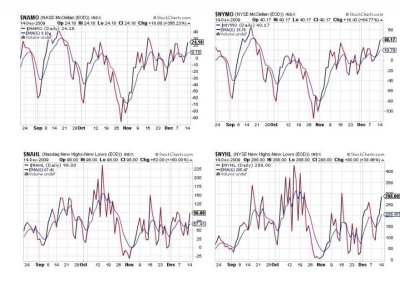

Four for four, all on a buy.

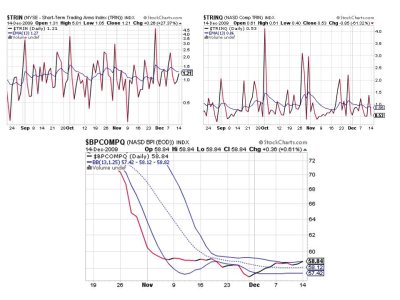

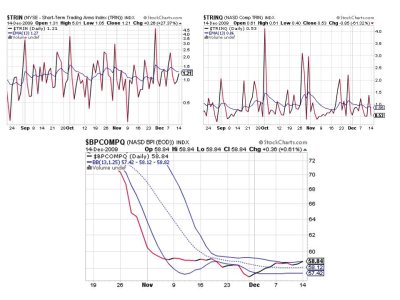

Three for three, all on a buy here too.

That's seven for seven signals on a buy, keeping the system on a buy. Any volume moves should come this week. The market is close to the upper end of its trading channel, so if we can close above 1119 on the S&P, maybe that next leg higher will finally happen. It's very early in the voting, but Trader's Talk is currently 71% bulls and 14% bears. That ratio should moderate to some degree by the open, but if traders are giving up on their short positions, we may have a hard time pushing higher.

Just trying to be objective.

See you tomorrow.

Tomorrow morning, three economic reports are scheduled to be released. Core PPI, PPI, and Empire Manufacturing. Wednesday we'll get Core CPI, CPI, and a FOMC announcement. So we have some potential market moving news coming. Here's today's charts:

Four for four, all on a buy.

Three for three, all on a buy here too.

That's seven for seven signals on a buy, keeping the system on a buy. Any volume moves should come this week. The market is close to the upper end of its trading channel, so if we can close above 1119 on the S&P, maybe that next leg higher will finally happen. It's very early in the voting, but Trader's Talk is currently 71% bulls and 14% bears. That ratio should moderate to some degree by the open, but if traders are giving up on their short positions, we may have a hard time pushing higher.

Just trying to be objective.

See you tomorrow.