I had expected (hoped actually) that Friday would have been the day we'd see some positive action following two down days, but it looks like I was one day off. But when I get a sell signal (last Thursday) I can't wait around for a trading day that suits me. So I follow the system for better or worse. It's the long term I'm interested in, so one day's action is meaningless for all intents and purposes, and hind sight in not a strategy.

I did not expect to see a buy signal too quick and felt the earliest we'd see one is next week (week of 5 Oct). That's my best guess and nothing more. I simply feel that bearishness rises too quick for a sell signal to last more than a month, and they haven't even been taking that long. But what I expect to happen is not necessarily what will happen, and that's where the Seven Sentinels system comes in.

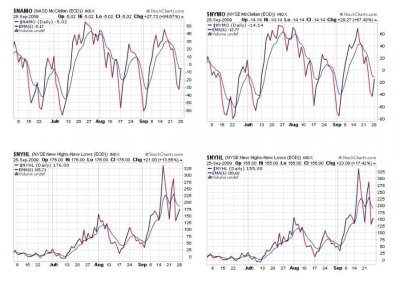

So did we get a signal today? No, we did not. Not yet anyway. Take a look:

Of the first four signals only NAMO came close to a buy, and it's borderline.

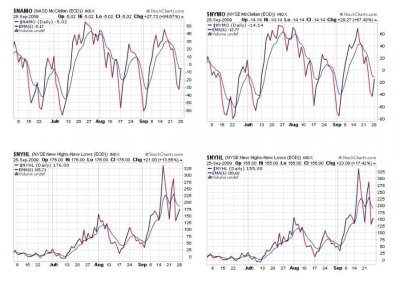

TRIN and TRINQ are back to buy territory, but BPCOMPQ is not.

So we only have 2 buy signals, one borderline signal, and 4 sell signals. It doesn't matter whether I call the borderline signal a buy or not as we need all seven to be in buy mode and they were not. So the Seven Sentinels remains on a sell.

I noted that today's volume on the S&P was very light. That is not what I'd expect to see on a decisive reversal, so the caution flag should still be waving.

I did not expect to see a buy signal too quick and felt the earliest we'd see one is next week (week of 5 Oct). That's my best guess and nothing more. I simply feel that bearishness rises too quick for a sell signal to last more than a month, and they haven't even been taking that long. But what I expect to happen is not necessarily what will happen, and that's where the Seven Sentinels system comes in.

So did we get a signal today? No, we did not. Not yet anyway. Take a look:

Of the first four signals only NAMO came close to a buy, and it's borderline.

TRIN and TRINQ are back to buy territory, but BPCOMPQ is not.

So we only have 2 buy signals, one borderline signal, and 4 sell signals. It doesn't matter whether I call the borderline signal a buy or not as we need all seven to be in buy mode and they were not. So the Seven Sentinels remains on a sell.

I noted that today's volume on the S&P was very light. That is not what I'd expect to see on a decisive reversal, so the caution flag should still be waving.