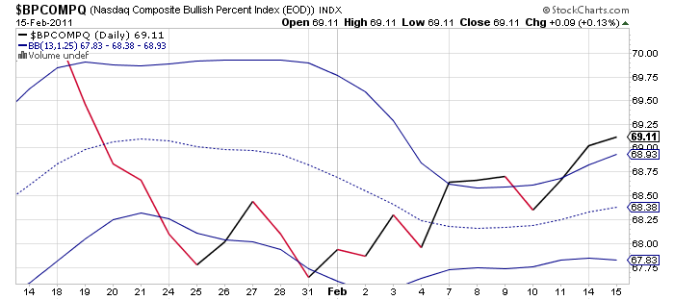

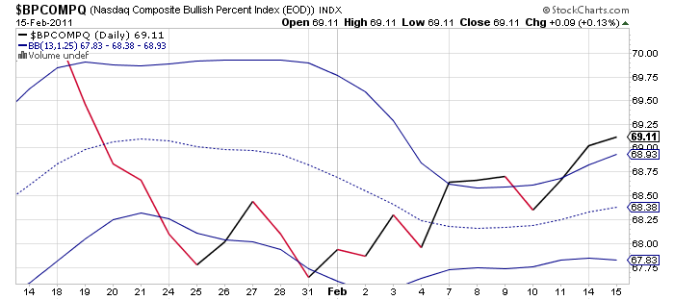

I need to begin tonight's blog with a correction of last night's charts and analysis. It doesn't really change anything all that much, but I need to address it anyway. In yesterday's charts it appeared that 6 of 7 signals were flashing buys with BPCOMPQ being the only hold out still in a sell condition. I realized this evening that the chart of BPCOMPQ was from Friday and that yesterday's chart shows that it also flipped to a buy. This means all seven signals were in a buy condition and that I only need a 28 day trading high from NYMO to confirm a buy condition. That condition was not quite met as it fell short by less than 2 points. So the system flashed another unconfirmed buy signal yesterday.

In today's action, the market pulled back a bit. And while this short term weakness may not be over just yet, it might serve as a launch point for fresh 2 year highs very soon. That's assuming the dip buyers are still out there, and I have little reason to doubt that.

While yesterday was largely devoid of catalysts to move the market, today provided more opportunity. This morning saw the release of January advance retail sales, which increased by 0.3%. Minus auto sales, that number didn't change. This data point was less than many economists expected. Worse, the previous month's report was revised downward.

February's Empire Manufacturing Survey came in at 15.4, which was largely inline with estimates.

January import prices were up 1.5%, while December business inventories increased 0.8%.

There was also some important overseas data released today. China's January CPI was up 4.9%, while the January PPI number came in at 6.6%. It would seem inflation is taking hold in China based on those numbers.

Fourth quarter GDP was up 0.4% in France and Germany, while the UK saw consumer prices jump 4.0% in January.

Here's today's charts:

NAMO and NYMO both flipped back to a sell condition.

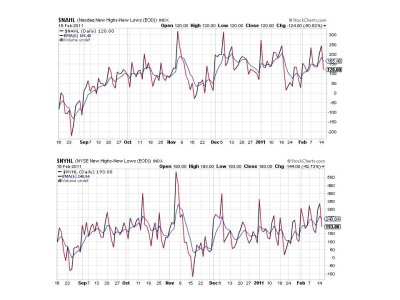

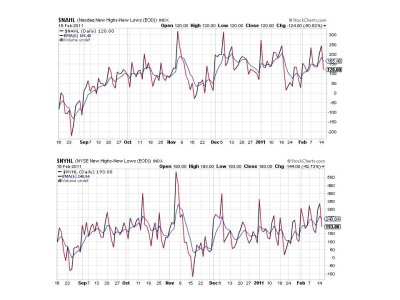

NAHL and NYHL also flipped back to sells.

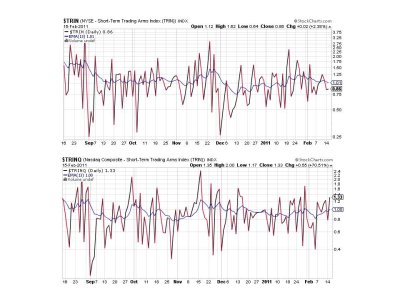

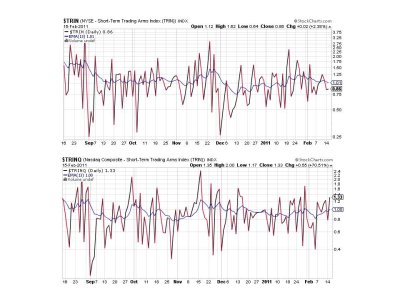

TRIN remained on a buy, while TRINQ spiked to a sell.

BPCOMPQ remained on a buy. I'd like to point out here that this signal has been moving sideways, but with an upward bias since the 1st of February. I consider this moderately bullish.

So I'm waiting for another confirmed signal to put the system back into an "official" position. I believe it will a buy signal, but I could be wrong. Given liquidity levels though, I don't see how a serious decline can take hold.

In today's action, the market pulled back a bit. And while this short term weakness may not be over just yet, it might serve as a launch point for fresh 2 year highs very soon. That's assuming the dip buyers are still out there, and I have little reason to doubt that.

While yesterday was largely devoid of catalysts to move the market, today provided more opportunity. This morning saw the release of January advance retail sales, which increased by 0.3%. Minus auto sales, that number didn't change. This data point was less than many economists expected. Worse, the previous month's report was revised downward.

February's Empire Manufacturing Survey came in at 15.4, which was largely inline with estimates.

January import prices were up 1.5%, while December business inventories increased 0.8%.

There was also some important overseas data released today. China's January CPI was up 4.9%, while the January PPI number came in at 6.6%. It would seem inflation is taking hold in China based on those numbers.

Fourth quarter GDP was up 0.4% in France and Germany, while the UK saw consumer prices jump 4.0% in January.

Here's today's charts:

NAMO and NYMO both flipped back to a sell condition.

NAHL and NYHL also flipped back to sells.

TRIN remained on a buy, while TRINQ spiked to a sell.

BPCOMPQ remained on a buy. I'd like to point out here that this signal has been moving sideways, but with an upward bias since the 1st of February. I consider this moderately bullish.

So I'm waiting for another confirmed signal to put the system back into an "official" position. I believe it will a buy signal, but I could be wrong. Given liquidity levels though, I don't see how a serious decline can take hold.