The market picked up where it left off yesterday with a gap lower followed by fairly sustained selling pressure throughout the day. It didn't help the bulls case that no jobs were created in today's employment report. That hasn't happened since WWII. And just in time for Labor Day...how fitting. Even nonfarm private payrolls were dismal with a mere 17,000 additions. A far cry from the 110,000 economists were looking for. The unemployment rate did hold steady at 9.1 percent however. That's comforting.

That sell-off in gold has largely been retraced now, as gold prices spiked 2.6% to $1877.20 per ounce today. And treasuries rallied hard too, as the benchmark 10-year Note's yield fell to 2.0%.

Trading was thin as many traders remain away from their desks, but that won't be the case next week.

U.S. markets will be closed on Monday in observance of Labor Day.

Here's today's charts:

Momentum to the downside picked up a bit for NAMO and NYMO. Both are now on sells.

NAHL and NYHL also fell and are flashing sells. But these signals suggest that market internals are not as weak as prices seem to indicate.

TRIN and TRINQ spiked higher today, with TRIN highly suggestive of an oversold market, while TRINQ is moderately so. I would expect higher prices early on in the week next week based on these two signals.

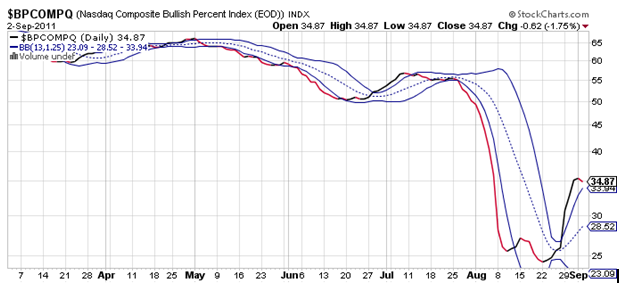

BPCOMPQ turned lower today, and while it wasn't a big turn that upper bollinger band is not far off, which means this signal could flip to a sell with more follow through to the downside. It is the only signal on a buy at the moment, but if Tuesday sees more hard selling pressure, I would expect to get an unconfirmed sell signal. But it's possible one could be generated later in the week too.

From Stock Traders almanac for Tuesday, the day after Labor Day; DOW up 13 of last 16, 1997 up 3.4% and 1998 up 5.0%. But September is also the biggest statistical loser going back more than 60 years.

Specifically, September is most dangerous during Triple-Witching week with continued pain often dished out the week after too. Last year however, September was a big winner. And that was the beginning of QE2. The Fed has not promised much in terms of QE3 though, they've only hinted at providing support should it be necessary. So I don't know if that plays this time around. But that's a quick run-down on September's overall prospects from a historical perspective.

Based on those statistics for post Labor Day action and the oversold TRIN and TRINQ conditions, I am anticipating higher prices early on next week. And our sentiment survey is sufficiently bearish to suggest the same. It's possible we test the highs, but this market is quite volatile and the news has been very bearish overall. And while that's a great prescription for a wall of worry, that doesn't mean the lows can't be tested again at some point before a resumption of any sustained upside move. That initial decline in August was steep, and I find it hard to believe the market will soon act as if it never happened.

I remain in the F fund and very cautious, although I am willing to enter the market again if I see a decent set-up. We're getting there now, but I don't think the downside is over yet.

Check back Sunday evening and I'll have the weekly Tracker charts posted. See you then.