The market continues to bob and weave (with a short term downward bias) and today's action continued that character as stocks opened up higher before eventually succumbing to significant selling pressure later in the afternoon.

There wasn't much going on the market today, but news out of the EU continues to be negative. The fact that financials were the hardest hit sector today (down 2.3%) also doesn't help the bullish case. In fact, Bank of America fell below $5 a share, which is its lowest level in more than 2 years.

Overall share volume was light, which I don't view as bullish either, given seasonality.

Here's today's charts:

Back to sells for NAMO and NYMO. They aren't falling off a cliff, but they remain firmly in bearish territory (below the zero line).

NAHL and NYHL also remain in sell conditions.

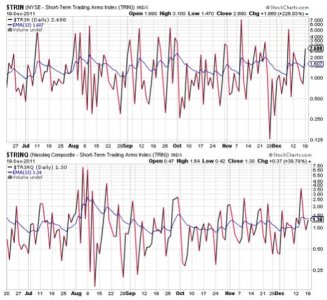

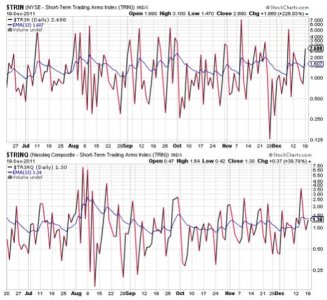

TRIN spiked into sell territory and is now suggesting a moderately oversold market, while TRINQ moved higher, but just barely remains on a buy.

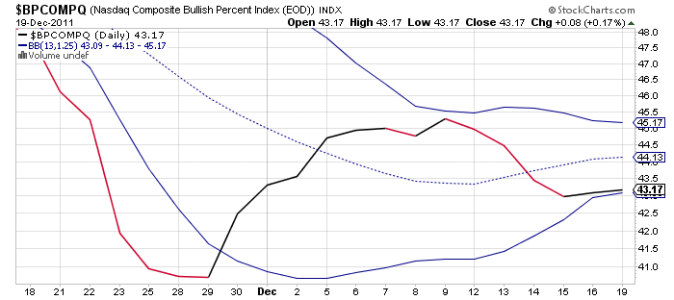

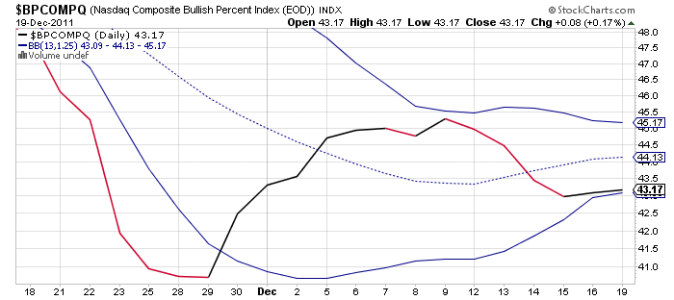

BPCOMPQ ebbed fractionally higher and remains on a buy, but it's flirting with that lower bollinger band and that may not bode well if this market doesn't turn higher soon.

So the signals remain mixed, but the system once again remains in a sell condition.

We are now in the most favorable time of year for stocks, but today's action was quite disheartening. It's not too late for a rally to materialize, but there seems to be more interest in selling than buying. The reading on TRIN may be good for a bounce tomorrow however, but beyond that I'm not sure what to think. Sentiment isn't "that" bullish, but this is still technically a bear market and seasonality may be providing an excuse to offload stocks.

There wasn't much going on the market today, but news out of the EU continues to be negative. The fact that financials were the hardest hit sector today (down 2.3%) also doesn't help the bullish case. In fact, Bank of America fell below $5 a share, which is its lowest level in more than 2 years.

Overall share volume was light, which I don't view as bullish either, given seasonality.

Here's today's charts:

Back to sells for NAMO and NYMO. They aren't falling off a cliff, but they remain firmly in bearish territory (below the zero line).

NAHL and NYHL also remain in sell conditions.

TRIN spiked into sell territory and is now suggesting a moderately oversold market, while TRINQ moved higher, but just barely remains on a buy.

BPCOMPQ ebbed fractionally higher and remains on a buy, but it's flirting with that lower bollinger band and that may not bode well if this market doesn't turn higher soon.

So the signals remain mixed, but the system once again remains in a sell condition.

We are now in the most favorable time of year for stocks, but today's action was quite disheartening. It's not too late for a rally to materialize, but there seems to be more interest in selling than buying. The reading on TRIN may be good for a bounce tomorrow however, but beyond that I'm not sure what to think. Sentiment isn't "that" bullish, but this is still technically a bear market and seasonality may be providing an excuse to offload stocks.