The market just doesn't seem to be paying much attention to news of late. Good or bad. Volume is up along with the major averages. In fact, volume on the NYSE closed above its 200-day average for the third straight session. The Dow closed on its high for the year, and finished higher for its eighth consecutive week, closing on its 200-week moving average. The S&P closed at its high of the day and was still tacking on a few points after the bell. It was also a 19-month high for that major index.

Maybe the Eurozone's plunge into the abyss is a factor. That's certainly a story that's just getting worse and promises to continue that path for the foreseeable future. Lot's of liquidity too.

And I don't think this rally is done yet either. Here's the charts:

NAMO and NYMO moved a bit higher today, and appears to be pointing to higher prices.

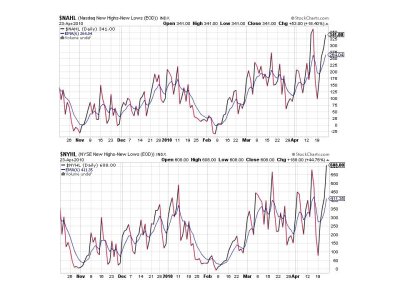

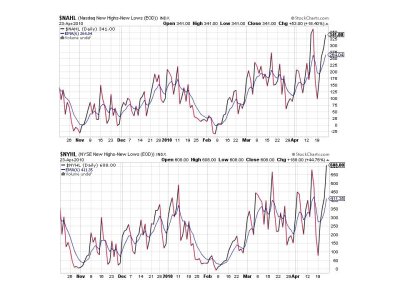

Both NAHL and NYHL are telling the same story. Money is moving into the market.

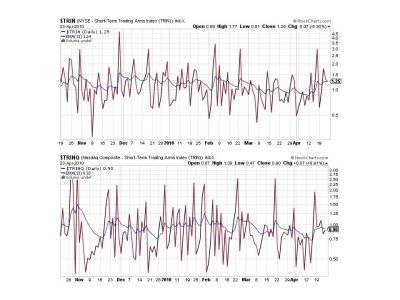

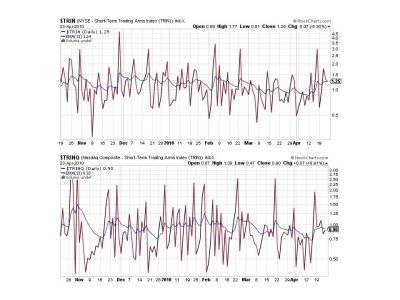

TRIN and TRINQ are not saying much of anything at the moment. TRIN is still on a sell, but barely. TRINQ is on a buy and also just barely. Pretty neutral I'd say.

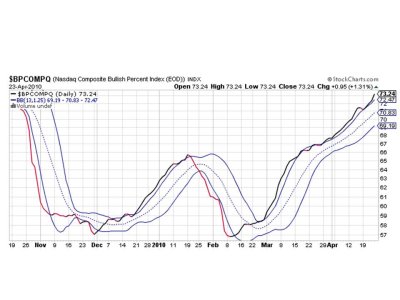

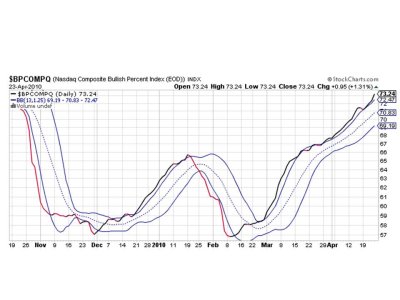

BPCOMPQ just elevated a bit more and that line is getting more vertical. The way this signal looks, I don't think I'd want to be sitting in cash next week.

So we still have 6 of 7 signals on a buy with one signal just barely flashing a sell. These signals continue to look bullish overall and with volume up I'd have to say we're going higher.

I'll be posting Top 15 and Top 50 charts this weekend. See you then.

Maybe the Eurozone's plunge into the abyss is a factor. That's certainly a story that's just getting worse and promises to continue that path for the foreseeable future. Lot's of liquidity too.

And I don't think this rally is done yet either. Here's the charts:

NAMO and NYMO moved a bit higher today, and appears to be pointing to higher prices.

Both NAHL and NYHL are telling the same story. Money is moving into the market.

TRIN and TRINQ are not saying much of anything at the moment. TRIN is still on a sell, but barely. TRINQ is on a buy and also just barely. Pretty neutral I'd say.

BPCOMPQ just elevated a bit more and that line is getting more vertical. The way this signal looks, I don't think I'd want to be sitting in cash next week.

So we still have 6 of 7 signals on a buy with one signal just barely flashing a sell. These signals continue to look bullish overall and with volume up I'd have to say we're going higher.

I'll be posting Top 15 and Top 50 charts this weekend. See you then.