We had a great follow-through day today, although unlike yesterday we saw some selling pressure during the course of trading. That was to be expected of course, as many traders have not embraced the notion of a change in trend. So we're bound to see some selling on the way back up (assuming we've already hit bottom).

In the news today, the International Monetary Fund increased its 2010 world GDP forecast to 4.6%, which was up from 4.2%. Additionally, the European Central Bank left its benchmark interest rate at unchanged at 1.00%, while the Bank of England kept its interest rate pegged at 0.50%.

But the latest weekly jobs report is being cited as the main reason for today's strength, which saw initial jobless claims for the week ending July 3 fall to 454,000. Continuing claims dropped much more. In fact it hit very close to a 20-year low. But this is another dubious data point as many worker's benefits have expired. That's hardly cause for celebration by any measure.

So far the past two trading sessions appear to suggesting the bottom is in and a change in trend is underway. It's still too early to fully embrace that scenario however, but market internals and the Seven Sentinels are looking good so far. But as I said we're not quite there yet. Here's the charts:

NAMO and NYMO are flashing strong buys right now.

NAHL and NYHL are also looking good.

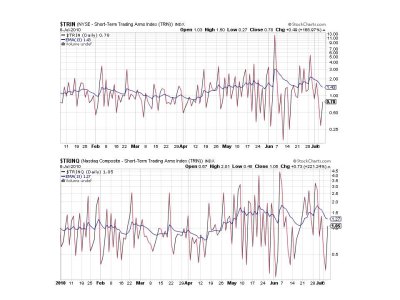

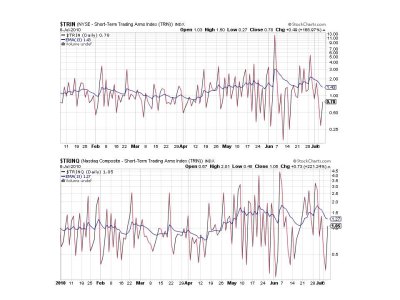

Still flashing buys here too.

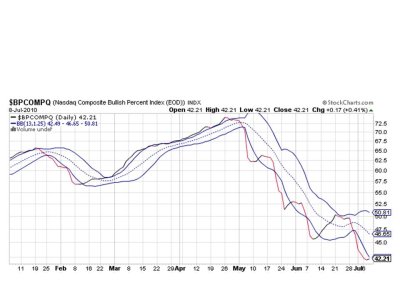

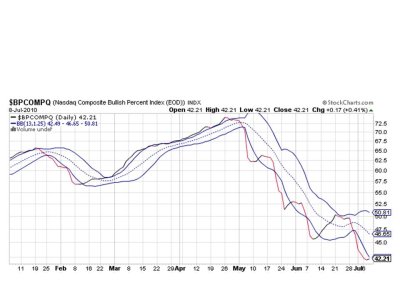

Almost, but not quite. BPCOMPQ needs just one more nudge and it will probably cross through the lower bollinger band giving us that final buy signal. Maybe tomorrow?

So we still have 6 of 7 signals flashing buys, and they are stronger buys at that, but BPCOMPQ has not quite gotten there yet. The system remains on a buy and if we can get another buy signal in the next couple of trading days I'd venture to say we have probably turned the trend back up.

In the news today, the International Monetary Fund increased its 2010 world GDP forecast to 4.6%, which was up from 4.2%. Additionally, the European Central Bank left its benchmark interest rate at unchanged at 1.00%, while the Bank of England kept its interest rate pegged at 0.50%.

But the latest weekly jobs report is being cited as the main reason for today's strength, which saw initial jobless claims for the week ending July 3 fall to 454,000. Continuing claims dropped much more. In fact it hit very close to a 20-year low. But this is another dubious data point as many worker's benefits have expired. That's hardly cause for celebration by any measure.

So far the past two trading sessions appear to suggesting the bottom is in and a change in trend is underway. It's still too early to fully embrace that scenario however, but market internals and the Seven Sentinels are looking good so far. But as I said we're not quite there yet. Here's the charts:

NAMO and NYMO are flashing strong buys right now.

NAHL and NYHL are also looking good.

Still flashing buys here too.

Almost, but not quite. BPCOMPQ needs just one more nudge and it will probably cross through the lower bollinger band giving us that final buy signal. Maybe tomorrow?

So we still have 6 of 7 signals flashing buys, and they are stronger buys at that, but BPCOMPQ has not quite gotten there yet. The system remains on a buy and if we can get another buy signal in the next couple of trading days I'd venture to say we have probably turned the trend back up.