In spite of the late day retreat by the broader market, the action continues to appear consistent with a bottoming process. That doesn't mean we can't go lower, but even if we do I don't think we're all that far off from a tradeable bottom.

The euro continues its march lower and has settled just off its 4 year low, so that may continue to roil the markets. Especially if it spikes lower.

Some market data released today saw total April durable goods orders post a 2.9% increase, but minus transportation brought that mark to -1%. But we have to keep in mind the previous month's reading was 4.8%, so at worse it is a mixed signal.

And of course the housing market is in obvious recovery, as new home sales for April spiked to an annualized rate of 504,000 units, the highest level in two years. Okay, so I'm being a tad sarcastic there.

But here's the important part; the Seven Sentinels improved today and are beginning to hint at a move towards a buy signal. It is still too early to call, but we do seem to be moving in that direction. Here's the charts:

Both NAMO and NYMO flipped to buys today.

NAHL and NYHL also flipped back to buys.

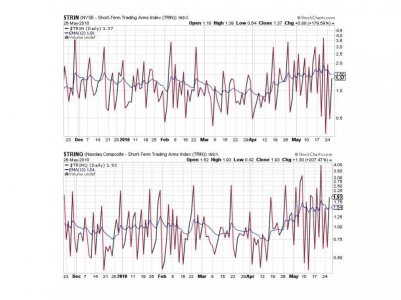

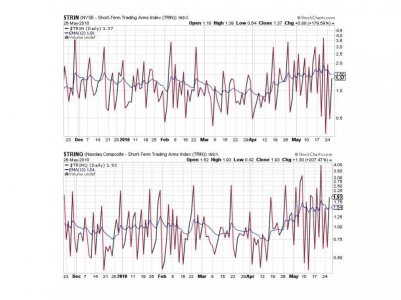

TRIN remained on a buy, but TRINQ flipped to a sell.

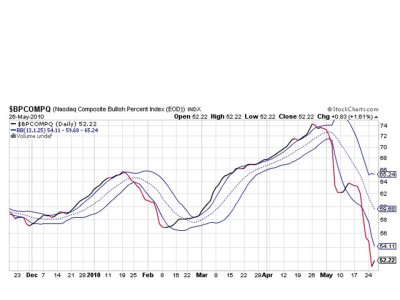

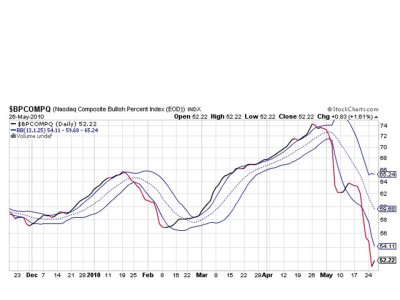

BPCOMPQ is now showing the possibility that's it's turning, as it inched up a bit today.

So only 2 of 7 signals remain on a sell. If the market can begin to trend higher, it may not be long before a buy signal is triggered. But volatility may not make an entry point easy if we continue to see up/down action. But those EMAs are starting to settle out at the lows, so the potential for a reversal gets more likely each day, even with the volatility. Of course there is still a chance we seek new lows, so an entry here is certainly not without risk. It's a tough call with TSP in the absence of a SS buy signal. Good luck on whatever you decide to do. See you tomorrow.

The euro continues its march lower and has settled just off its 4 year low, so that may continue to roil the markets. Especially if it spikes lower.

Some market data released today saw total April durable goods orders post a 2.9% increase, but minus transportation brought that mark to -1%. But we have to keep in mind the previous month's reading was 4.8%, so at worse it is a mixed signal.

And of course the housing market is in obvious recovery, as new home sales for April spiked to an annualized rate of 504,000 units, the highest level in two years. Okay, so I'm being a tad sarcastic there.

But here's the important part; the Seven Sentinels improved today and are beginning to hint at a move towards a buy signal. It is still too early to call, but we do seem to be moving in that direction. Here's the charts:

Both NAMO and NYMO flipped to buys today.

NAHL and NYHL also flipped back to buys.

TRIN remained on a buy, but TRINQ flipped to a sell.

BPCOMPQ is now showing the possibility that's it's turning, as it inched up a bit today.

So only 2 of 7 signals remain on a sell. If the market can begin to trend higher, it may not be long before a buy signal is triggered. But volatility may not make an entry point easy if we continue to see up/down action. But those EMAs are starting to settle out at the lows, so the potential for a reversal gets more likely each day, even with the volatility. Of course there is still a chance we seek new lows, so an entry here is certainly not without risk. It's a tough call with TSP in the absence of a SS buy signal. Good luck on whatever you decide to do. See you tomorrow.