After yesterday's selling spree, trader's began the day driving prices right back up in spite of some disappointing retail sales numbers released prior to the open.

Retail sales for November came in a 0.2%, which was below estimates calling for 0.6%. Minus autos that number remained at 0.2%, but that was still below expectations of 0.5%.

But while the market came out of the opening bell strong it didn't last much more than the first half hour of trading, which is where the market hit its high of the day. It then dropped back and traded around the neutral line for several hours until the FOMC announcement was released.

Today's FOMC policy statement offered little in the way of revelations, but the market was looking for talk of QE3 and that didn't happen. It was downhill from there as the broader market sold off, ending the day with significant losses.

After hours there was some news regarding real estate that really makes one wonder why we should pay any attention at all to anything we're told about the health of our economy. The National Association of Realtors has announced that they've significantly overcounted the number of home sales since 2007.

Here's tonight's charts:

NAMO and NYMO moved lower today and remain in sell conditions.

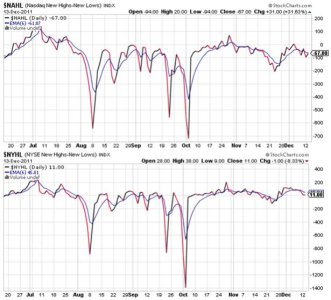

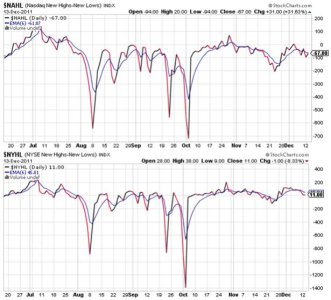

NAHL actually moved higher, while NYHL tracked sideways. Both remain on sells, but remain near their respective 6 day EMAs.

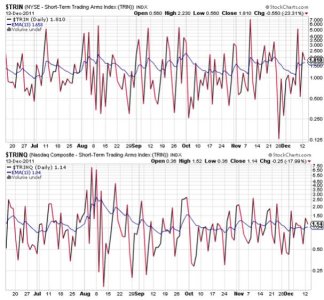

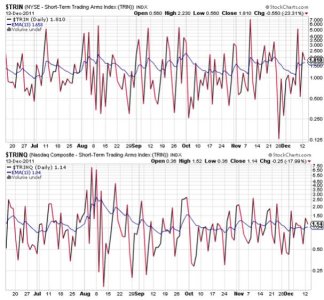

TRIN and TRINQ also remain on sells, but are very neutral overall.

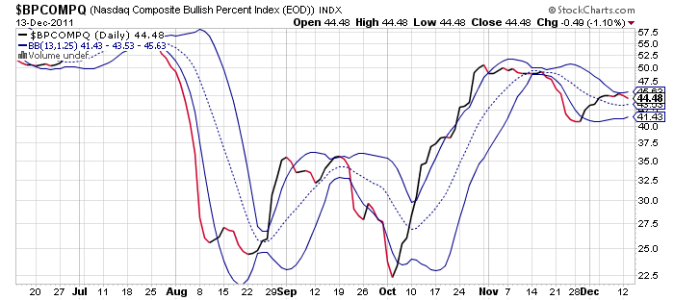

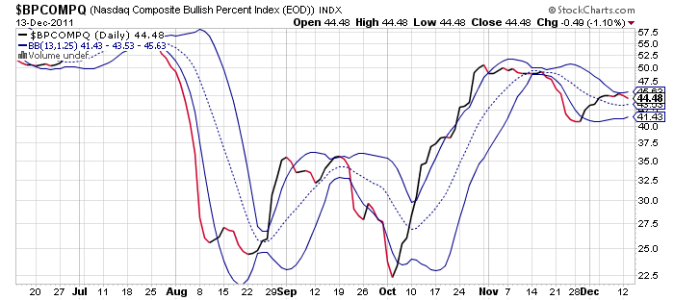

BPCOMPQ tracked a bit lower today, but is hardly falling off a cliff. It remains in a buy condition. That could be telling.

So the signals are mixed, but the system officially remains in a sell condition.

This market is not doing a whole lot of anything other then keeping both bulls and bears guessing where prices will go next. I still believe those three unconfirmed buy signals are early warnings of a breakout to the upside, but that's not a slam dunk.

Of interest is the FOMC policy statement today. The market sold off hard after it was released. The market often reverses its initial reaction shortly after this particular event. And given OPEX week's generally supportive nature, I have to like the odds of a move higher here. Perhaps even a breakout to the upside over the coming days.

I could not foresee what the FOMC might announce today, nor how the market would react to it, but I did execute my second IFT today and now have a 100% S fund position. Am I comfortable? No. But I do like the fact that the market sold off today as it fits in with my short term bullish outlook. However, other traders that I watch are not so bullish. Then again, that's what makes a market.

Retail sales for November came in a 0.2%, which was below estimates calling for 0.6%. Minus autos that number remained at 0.2%, but that was still below expectations of 0.5%.

But while the market came out of the opening bell strong it didn't last much more than the first half hour of trading, which is where the market hit its high of the day. It then dropped back and traded around the neutral line for several hours until the FOMC announcement was released.

Today's FOMC policy statement offered little in the way of revelations, but the market was looking for talk of QE3 and that didn't happen. It was downhill from there as the broader market sold off, ending the day with significant losses.

After hours there was some news regarding real estate that really makes one wonder why we should pay any attention at all to anything we're told about the health of our economy. The National Association of Realtors has announced that they've significantly overcounted the number of home sales since 2007.

Here's tonight's charts:

NAMO and NYMO moved lower today and remain in sell conditions.

NAHL actually moved higher, while NYHL tracked sideways. Both remain on sells, but remain near their respective 6 day EMAs.

TRIN and TRINQ also remain on sells, but are very neutral overall.

BPCOMPQ tracked a bit lower today, but is hardly falling off a cliff. It remains in a buy condition. That could be telling.

So the signals are mixed, but the system officially remains in a sell condition.

This market is not doing a whole lot of anything other then keeping both bulls and bears guessing where prices will go next. I still believe those three unconfirmed buy signals are early warnings of a breakout to the upside, but that's not a slam dunk.

Of interest is the FOMC policy statement today. The market sold off hard after it was released. The market often reverses its initial reaction shortly after this particular event. And given OPEX week's generally supportive nature, I have to like the odds of a move higher here. Perhaps even a breakout to the upside over the coming days.

I could not foresee what the FOMC might announce today, nor how the market would react to it, but I did execute my second IFT today and now have a 100% S fund position. Am I comfortable? No. But I do like the fact that the market sold off today as it fits in with my short term bullish outlook. However, other traders that I watch are not so bullish. Then again, that's what makes a market.