In a market as strong as this one it can be quite difficult to find comfortable entry points. Weakness, when we've had some, has not lasted long at all. So while I had hoped for a follow-through day to the downside today, I was under no illusions that I would get what I wanted. Which is why I entered the market today in the one sector that was red. The EAFE (I Fund).

Although stocks immediately began trading in the red, they quickly turned on the ADP employment reading, which showed 300,000 private payrolls were added last month. That's about triple the anticipated number. As a result of that number there's speculation that Friday's non-farm payrolls report will also surprise.

The dollar was up a healthy 1.0% today, which is why the I fund lagged so bad. That's 3 gains in a row after 7 losses in a row.

I noticed treasuries getting hammered early on today, and that tone didn't change much as trading wore on. AGG, which our F fund roughly tracks, was down 0.48% today.

Here's today's charts:

NAMO flipped back to a buy on a today's action, while NYMO managed to get back to its 6 day EMA, which makes it neutral.

NAHL and NYHL ticked a bit lower and remain on modest sells.

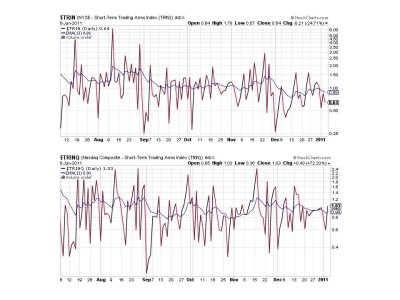

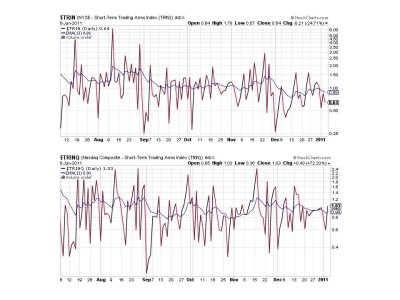

TRIN remained on a buy, while TRINQ flipped to a sell.

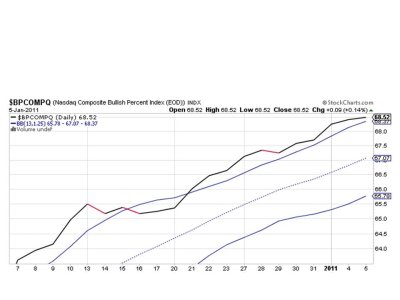

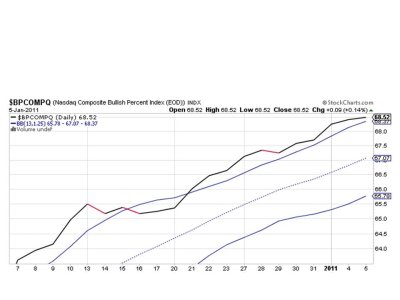

BPCOMPQ inched higher still and remains on a buy.

So the system remains on a buy with those readings.

I had said I did not expect any weakness to last too long and today's action seems to support that contention. I chose to enter the market today as the Sentinels have been on a buy since 21Dec and I finally got a bit of weakness to buy in to. Sentiment is still a concern, but one that is not likely to turn this market too soon.

Although stocks immediately began trading in the red, they quickly turned on the ADP employment reading, which showed 300,000 private payrolls were added last month. That's about triple the anticipated number. As a result of that number there's speculation that Friday's non-farm payrolls report will also surprise.

The dollar was up a healthy 1.0% today, which is why the I fund lagged so bad. That's 3 gains in a row after 7 losses in a row.

I noticed treasuries getting hammered early on today, and that tone didn't change much as trading wore on. AGG, which our F fund roughly tracks, was down 0.48% today.

Here's today's charts:

NAMO flipped back to a buy on a today's action, while NYMO managed to get back to its 6 day EMA, which makes it neutral.

NAHL and NYHL ticked a bit lower and remain on modest sells.

TRIN remained on a buy, while TRINQ flipped to a sell.

BPCOMPQ inched higher still and remains on a buy.

So the system remains on a buy with those readings.

I had said I did not expect any weakness to last too long and today's action seems to support that contention. I chose to enter the market today as the Sentinels have been on a buy since 21Dec and I finally got a bit of weakness to buy in to. Sentiment is still a concern, but one that is not likely to turn this market too soon.