rangerray

TSP Pro

- Reaction score

- 209

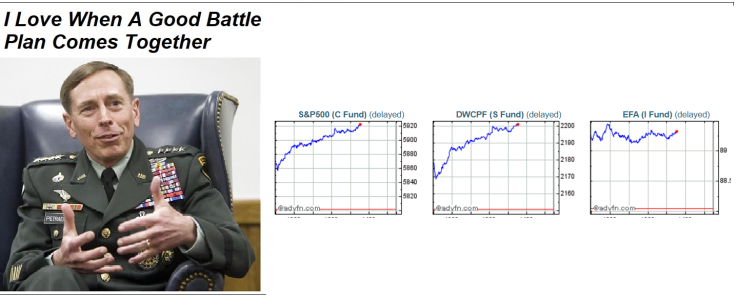

Leaving nearly 2 months of safety in G, and going 50% I, 25% C, 25% S COB Today.

Despite Negative GDP....stocks already seem to have bottomed intraday and starting to move upward.

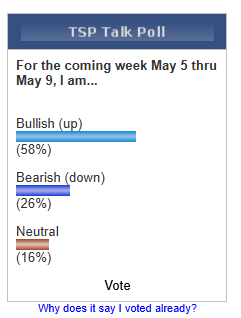

Will stay nimble in May...but now FOMO starting to set in market-wide, could push stocks significantly higher.

I think a surge in imports accounts for the negative GDP, so I’m not too concerned about that.

Sent from my iPhone using Tapatalk