It took over 2 months, but the S&P 500 finally achieved a new high for the year and its highest close in almost 3 years.

There were a number of companies that reported earnings today. Here's how the current group fared:

Illinois Tool Works (ITW 57.73, +3.32), 3M (MMM 95.94, +1.82), Humana (HUM 76.69, +4.01), UPS (UPS 74.30, +0.66), Ford (F 15.66, +0.12), Delta Air Lines (DAL 9.99, +0.99), US Airways (LCC 8.80, +0.52), IBM (IBM 168.49, +0.82), Coca-Cola (KO 66.93, -0.81), Netflix (NFLX 228.91, -22.76), and Under Armour (UA 69.64, -8.83).

In spite of the broad-based buying and upbeat tempo of today's action, overall volume wasn't impressive as the NYSE only saw 900 million shares traded. It could be that participants are cautiously loading up prior to tomorrow's FOMC policy statement, which is becoming more speculative than previous statements as inflation concerns are increasing and also because the Fed Chiefs are not in total agreement of policy action moving forward.

Here's today's charts:

NAMO and NYMO remain on buys.

Same with NAHL and NYHL

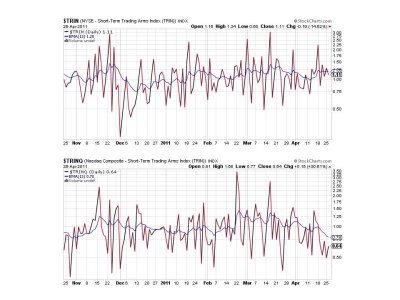

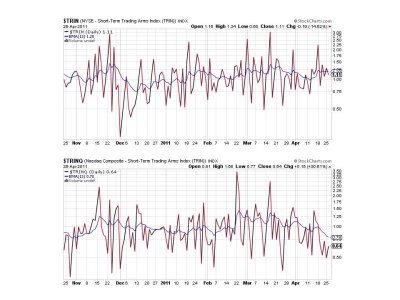

TRIN and TRINQ are also flashing buys. The 13 day EMA for TRINQ is at a low level, which normally suggests we're due for some weakness, but it's possible we're in the early stages of a move higher too. I say this because of the rising uncertainty of Fed action. A rally in front of a policy shift would not surprise me, but that doesn't necessarily mean a change in policy is close at hand. It's just a possibility.

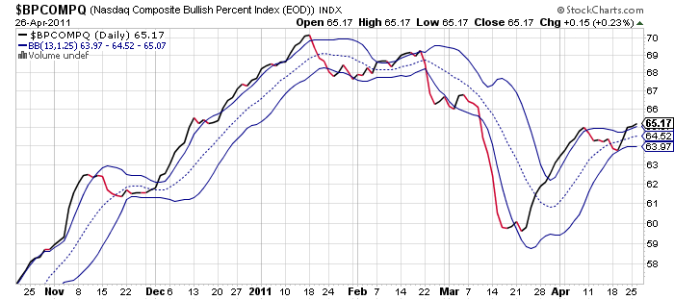

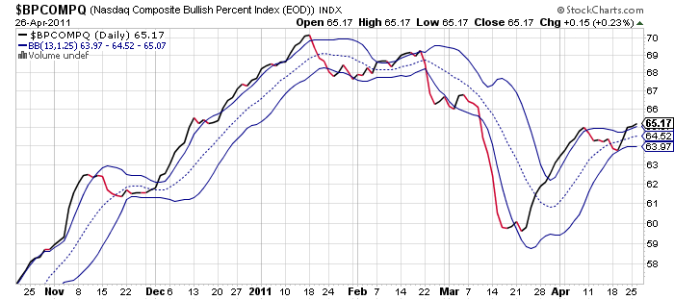

BPCOMPQ is hugging that upper bollinger band and remains in a buy condition.

So all signals are flashing buys, which keeps the system on a buy.

We've hit fresh highs, but we still have that gap below on the S&P 500 and a Fed announcement on tap tomorrow. And I'm suspicious of how the big money may play this. That gap may serve as a bear trap, so I'm not convinced it's a given it will be filled in the short term, although that's still the more likely outcome in a volatile market. It's not May yet either, so maybe we march higher for now and the selling comes sometime next month. I'm just not sure, but it will be interesting to see how it plays out.

There were a number of companies that reported earnings today. Here's how the current group fared:

Illinois Tool Works (ITW 57.73, +3.32), 3M (MMM 95.94, +1.82), Humana (HUM 76.69, +4.01), UPS (UPS 74.30, +0.66), Ford (F 15.66, +0.12), Delta Air Lines (DAL 9.99, +0.99), US Airways (LCC 8.80, +0.52), IBM (IBM 168.49, +0.82), Coca-Cola (KO 66.93, -0.81), Netflix (NFLX 228.91, -22.76), and Under Armour (UA 69.64, -8.83).

In spite of the broad-based buying and upbeat tempo of today's action, overall volume wasn't impressive as the NYSE only saw 900 million shares traded. It could be that participants are cautiously loading up prior to tomorrow's FOMC policy statement, which is becoming more speculative than previous statements as inflation concerns are increasing and also because the Fed Chiefs are not in total agreement of policy action moving forward.

Here's today's charts:

NAMO and NYMO remain on buys.

Same with NAHL and NYHL

TRIN and TRINQ are also flashing buys. The 13 day EMA for TRINQ is at a low level, which normally suggests we're due for some weakness, but it's possible we're in the early stages of a move higher too. I say this because of the rising uncertainty of Fed action. A rally in front of a policy shift would not surprise me, but that doesn't necessarily mean a change in policy is close at hand. It's just a possibility.

BPCOMPQ is hugging that upper bollinger band and remains in a buy condition.

So all signals are flashing buys, which keeps the system on a buy.

We've hit fresh highs, but we still have that gap below on the S&P 500 and a Fed announcement on tap tomorrow. And I'm suspicious of how the big money may play this. That gap may serve as a bear trap, so I'm not convinced it's a given it will be filled in the short term, although that's still the more likely outcome in a volatile market. It's not May yet either, so maybe we march higher for now and the selling comes sometime next month. I'm just not sure, but it will be interesting to see how it plays out.