___

Here are some of the headlines ripped from my Google news account.

This stock market needs a correction

Lessons from stock-market rigging history

Stock market cash being sent to 'safe haven'

What to Do When Stock Market Starts to Crack?

How to make sense of the stock market's wild ride

Stock plunge continues, Nasdaq drops below 4000

Don't Be Surprised If This Is The Start Of A Stock Market Crash ...

Most rational folks would call it a Pullback when the markets retrace 10%, a Correction 20% with a Bear Market pulling back more than 20%. As we can see from the headlines, the media has amplified the hype.

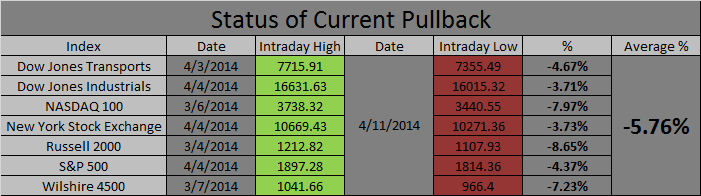

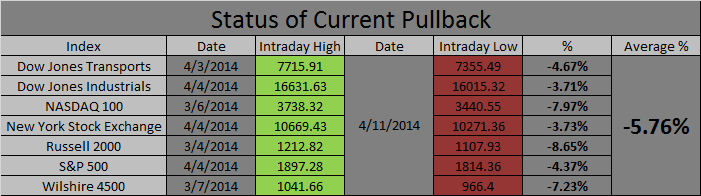

And here's the reality as it stands today. From the Status of Current Pullback chart below, we can see the Russell 2000 was the first to put in its top on March 4th and from this point on, the other indexes began to follow. There is a reason they say "Small Caps lead the way." Looking at all the Indexes, we can see the pullback ranges from -3.71% to -8.65% with the average being -5.76%, this is what I'd call typical market behavior, what wasn't typical were many of the shallow pullbacks we received in 2013. As a result, we became accustomed to those shallow pullbacks and now that we've come back to the linear norm, the media is freaking out.

___

So let's take a quick look at some of these Indexes and see where they are in relation to each other.

The Transportation Index is resting on its 6-Month trendline, if we pullback further, then I might expect a bounce off the descending red trendline. From there we may create a descending parallel price channel but at this juncture it's just speculation based on my many years of inexperience

___

Next up is the dangerously descending NASDAQ 100. Some folks may wonder why I track this Index instead of just the regular NASDAQ. Years ago I performed a study to see which of these two Indexes leads first. I found there were times when the NASDAQ 100 leads the NASDAQ by 1 day, it's a small edge we can use to our advantage. Case in point, with this recent pullback, the NASDAQ 100 topped out on March 6th while the NASDAQ topped out on March 7th.

With this chart, we see it's broken the 6-Month trendline and failed the re-test. Here we can see a clearly defined Left Shoulder followed by the Head with the proportions looking very good. Based on this speculation, we could expect to see a 50-75% bounce to form the Right Shoulder, before going back down to test the Neckline around the last week of May.

___

Now for the wildly watched S&P 500. Here, we have not tested the 6-Month trendline but we have a short-term Head & Shoulders pattern I'm giving a price objective of 1795-1775.

___

And lastly we have the Wilshire 4500. This beautiful chart has tested and closed just above its 6-Month trendline. Once again we see potential for a Head & Shoulders pattern with the Right Shoulder yet to be formed. if we can hold current levels, then I would like to see us crawl into the descending parallel price channel I've created, perhaps we could bounce around there for awhile.

For those of you looking for some advice, I have the following words to offer.

Here are some of the warning signs we've received thus far, this year.

1) The first 3 days of January closed down

2) The Month of January closed down

3) The December Low indicator was triggered on 3 February

4) The Russell 2000 topped out on March 4th (a month before the S&P 500)

While we cannot predict future prices, we can say that this last round of price action was not surprising in the least. If we watch price and volume across multiple indexes and timeframes, the warning signs reveal themselves more often than not. Combine this with seasonality (read your Traders Almanac) and we have a fairly reliable way to keep ourselves out of trouble. But having information and executing trades are two different things, we should all "Plan our work and work our plan."

For those of you who have absorbed the pain and are wondering if you should bail out, the best advice I have is to trade until you can sleep. It may sound like stupid advice, but it works for me so I use it. As an example, I've been invested in the C&S funds a total of 17 of 72 trading days, just 24% of the time and I sleep well. Don't get me wrong, I've stomached some steep pullbacks in the past but it burned me up real bad, so for my trading style I'd rather just get out and let the markets settle down.

Looking out to the long-term, I might expect the markets to rally into the end of May, with the tradtional "Sell in May and go away" season taking us down until the June/July summer rally. In the short-term I expect to enter on Monday or Tuesday but I do not know how long the trade will last. Right now, capital preservation is more important than risk, so the trade may only last a few days at best.

Take care...Jason

Here are some of the headlines ripped from my Google news account.

This stock market needs a correction

Lessons from stock-market rigging history

Stock market cash being sent to 'safe haven'

What to Do When Stock Market Starts to Crack?

How to make sense of the stock market's wild ride

Stock plunge continues, Nasdaq drops below 4000

Don't Be Surprised If This Is The Start Of A Stock Market Crash ...

Most rational folks would call it a Pullback when the markets retrace 10%, a Correction 20% with a Bear Market pulling back more than 20%. As we can see from the headlines, the media has amplified the hype.

And here's the reality as it stands today. From the Status of Current Pullback chart below, we can see the Russell 2000 was the first to put in its top on March 4th and from this point on, the other indexes began to follow. There is a reason they say "Small Caps lead the way." Looking at all the Indexes, we can see the pullback ranges from -3.71% to -8.65% with the average being -5.76%, this is what I'd call typical market behavior, what wasn't typical were many of the shallow pullbacks we received in 2013. As a result, we became accustomed to those shallow pullbacks and now that we've come back to the linear norm, the media is freaking out.

___

So let's take a quick look at some of these Indexes and see where they are in relation to each other.

The Transportation Index is resting on its 6-Month trendline, if we pullback further, then I might expect a bounce off the descending red trendline. From there we may create a descending parallel price channel but at this juncture it's just speculation based on my many years of inexperience

___

Next up is the dangerously descending NASDAQ 100. Some folks may wonder why I track this Index instead of just the regular NASDAQ. Years ago I performed a study to see which of these two Indexes leads first. I found there were times when the NASDAQ 100 leads the NASDAQ by 1 day, it's a small edge we can use to our advantage. Case in point, with this recent pullback, the NASDAQ 100 topped out on March 6th while the NASDAQ topped out on March 7th.

With this chart, we see it's broken the 6-Month trendline and failed the re-test. Here we can see a clearly defined Left Shoulder followed by the Head with the proportions looking very good. Based on this speculation, we could expect to see a 50-75% bounce to form the Right Shoulder, before going back down to test the Neckline around the last week of May.

___

Now for the wildly watched S&P 500. Here, we have not tested the 6-Month trendline but we have a short-term Head & Shoulders pattern I'm giving a price objective of 1795-1775.

___

And lastly we have the Wilshire 4500. This beautiful chart has tested and closed just above its 6-Month trendline. Once again we see potential for a Head & Shoulders pattern with the Right Shoulder yet to be formed. if we can hold current levels, then I would like to see us crawl into the descending parallel price channel I've created, perhaps we could bounce around there for awhile.

For those of you looking for some advice, I have the following words to offer.

Here are some of the warning signs we've received thus far, this year.

1) The first 3 days of January closed down

2) The Month of January closed down

3) The December Low indicator was triggered on 3 February

4) The Russell 2000 topped out on March 4th (a month before the S&P 500)

While we cannot predict future prices, we can say that this last round of price action was not surprising in the least. If we watch price and volume across multiple indexes and timeframes, the warning signs reveal themselves more often than not. Combine this with seasonality (read your Traders Almanac) and we have a fairly reliable way to keep ourselves out of trouble. But having information and executing trades are two different things, we should all "Plan our work and work our plan."

For those of you who have absorbed the pain and are wondering if you should bail out, the best advice I have is to trade until you can sleep. It may sound like stupid advice, but it works for me so I use it. As an example, I've been invested in the C&S funds a total of 17 of 72 trading days, just 24% of the time and I sleep well. Don't get me wrong, I've stomached some steep pullbacks in the past but it burned me up real bad, so for my trading style I'd rather just get out and let the markets settle down.

Looking out to the long-term, I might expect the markets to rally into the end of May, with the tradtional "Sell in May and go away" season taking us down until the June/July summer rally. In the short-term I expect to enter on Monday or Tuesday but I do not know how long the trade will last. Right now, capital preservation is more important than risk, so the trade may only last a few days at best.

Take care...Jason