Boghie

Market Veteran

- Reaction score

- 378

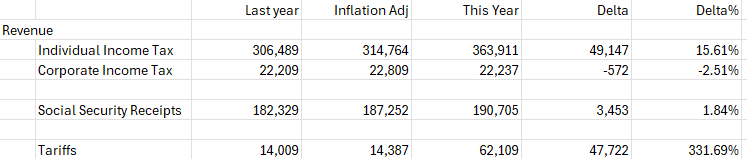

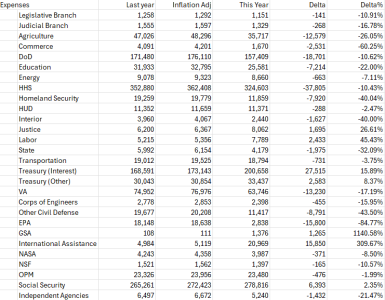

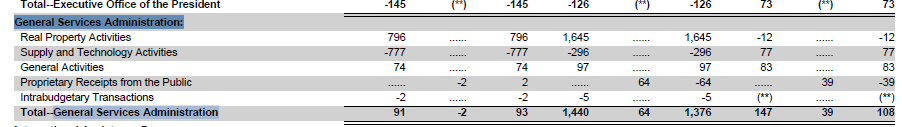

Reviewing the Monthly Treasury Statement (truncated at billions because millions are chump change ):

):

Personally, I think this is more a driver for interest rates than some FED wiggle. The Federal Government is squeezing the bond/debt market with their heavy usage of credit. That will increase interest rates. We want to see Revenue go up, Expenses go down, and most importantly the borrowing (deficit) shrink. If we see interest rates hold steady or increase even when the FED decreases the base rate than things are bad. Very bad...

Another thing...

If 'Revenue' is increasing that is a trailing indicator of economic growth. You don't pay tax on loss. It could be passive gain, but that will be a minor tick. I may use this thread to document deep dive thoughts from the statement.

Finally, another last thing...

It's not really safe to take one month snapshots of the Monthly Treasury Statement. I know that sounds odd, but sometimes an expense will be paid out at the end of a month when it is normally disbursed at the beginning of the month, so... To see patterns look for anomalies. Group like(ish) months. Look at last year's revenue and spending patterns.

| Revenue | Expenses | Deficit | |

| FY2025 (2024/10 -> 2024/11) | 627 | 1272 | 623 |

| FY2026 (2025/10 -> 2025/11) | 740 | 1198 | 457 |

Personally, I think this is more a driver for interest rates than some FED wiggle. The Federal Government is squeezing the bond/debt market with their heavy usage of credit. That will increase interest rates. We want to see Revenue go up, Expenses go down, and most importantly the borrowing (deficit) shrink. If we see interest rates hold steady or increase even when the FED decreases the base rate than things are bad. Very bad...

Another thing...

If 'Revenue' is increasing that is a trailing indicator of economic growth. You don't pay tax on loss. It could be passive gain, but that will be a minor tick. I may use this thread to document deep dive thoughts from the statement.

Finally, another last thing...

It's not really safe to take one month snapshots of the Monthly Treasury Statement. I know that sounds odd, but sometimes an expense will be paid out at the end of a month when it is normally disbursed at the beginning of the month, so... To see patterns look for anomalies. Group like(ish) months. Look at last year's revenue and spending patterns.