In a way, I find it encouraging that buyers were willing to push the major averages back up on a Friday in spite of the continued social and political turmoil in the Middle East and North Africa. I had expected to see some measure of selling pressure during the afternoon session, but it never materialized. I'd have to count that a positive development. And the VIX fell 9.3% as a result of today's action.

Oil tacked on 0.7%, which brought the cost of a barrel of oil to $97.97. This was interesting given oil production out of Libya is expected to halt for security reasons. The increase in production by OPEC may have quelled fears for now.

In market data today, fourth quarter GDP was revised downward to 2.8% after an advance reading came in at 3.2%. This was lower than economists had expected, which more on the order of 3.3%.

The final February Consumer Sentiment Survey came in at 77.5, which was the highest reading since January 2008.

All in all it was a welcome advance, but we are certainly not out of the woods yet.

Here's the charts:

NAMO and NYMO are bounced hard are now back in positive territory. They are both on buys now.

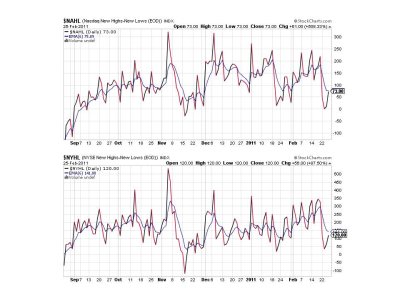

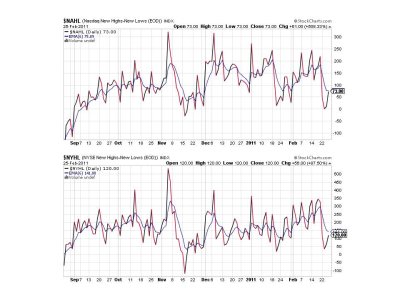

NAHL and NYHL have bounced smartly too, but remain on sells.

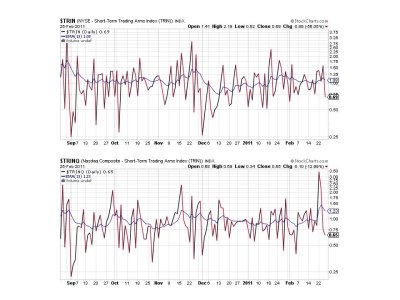

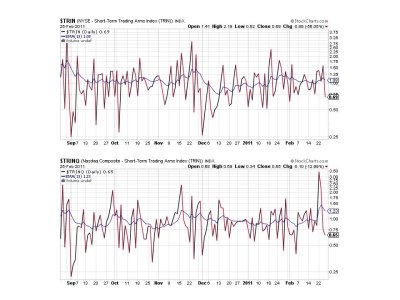

TRIN and TRINQ are both flashing buys.

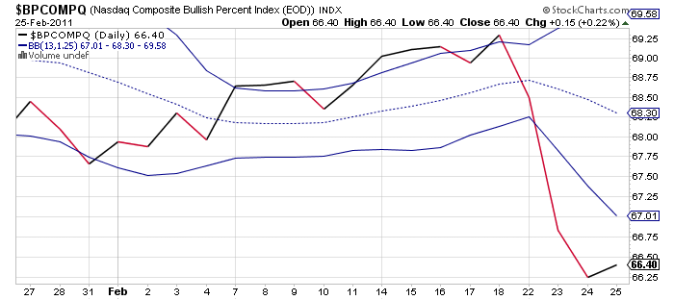

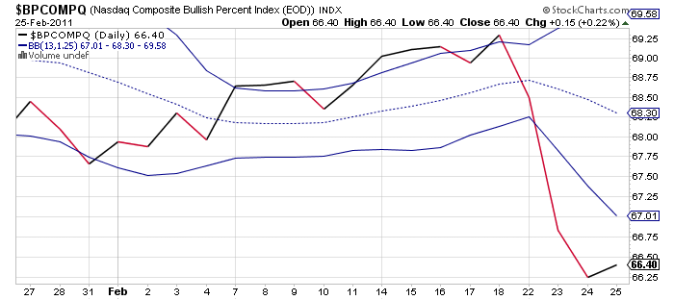

BPCOMPQ managed to eke a bit higher, but remains on a sell.

So 4 of 7 signals are flashing buys, which keeps the system on a buy. I am not complacent about this market however. There are still many unknowns that are not priced in because no one knows how the current geopolitical unrest will play out. Of particular concern is the potential for Saudi Arabia to become destabilized, although other countries facing similar protests matter too. Obviously this is something being watched and weighed very carefully by market forces. But as I mentioned early on, the fact that so much buying took place before the weekend with only token attempts to sell off has to be taken as a positive for at least the very short term.

I'll be posting the tracker charts over the weekend. It'll be interesting to see how we're positioned after the wild ride we've had this week.

Oil tacked on 0.7%, which brought the cost of a barrel of oil to $97.97. This was interesting given oil production out of Libya is expected to halt for security reasons. The increase in production by OPEC may have quelled fears for now.

In market data today, fourth quarter GDP was revised downward to 2.8% after an advance reading came in at 3.2%. This was lower than economists had expected, which more on the order of 3.3%.

The final February Consumer Sentiment Survey came in at 77.5, which was the highest reading since January 2008.

All in all it was a welcome advance, but we are certainly not out of the woods yet.

Here's the charts:

NAMO and NYMO are bounced hard are now back in positive territory. They are both on buys now.

NAHL and NYHL have bounced smartly too, but remain on sells.

TRIN and TRINQ are both flashing buys.

BPCOMPQ managed to eke a bit higher, but remains on a sell.

So 4 of 7 signals are flashing buys, which keeps the system on a buy. I am not complacent about this market however. There are still many unknowns that are not priced in because no one knows how the current geopolitical unrest will play out. Of particular concern is the potential for Saudi Arabia to become destabilized, although other countries facing similar protests matter too. Obviously this is something being watched and weighed very carefully by market forces. But as I mentioned early on, the fact that so much buying took place before the weekend with only token attempts to sell off has to be taken as a positive for at least the very short term.

I'll be posting the tracker charts over the weekend. It'll be interesting to see how we're positioned after the wild ride we've had this week.