-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

F Fund

- Thread starter BearTrap

- Start date

Re: F vs G Fund

Can someone explain how and when one should choose F fund over G fund? Don't understand F fund very well but hate to just park in G fund if there is some potential in F fund. Especially during this crazy crisis that involves government stimulus and possibility of deflation economy. Thx in advance

Can someone explain how and when one should choose F fund over G fund? Don't understand F fund very well but hate to just park in G fund if there is some potential in F fund. Especially during this crazy crisis that involves government stimulus and possibility of deflation economy. Thx in advance

- Reaction score

- 858

Re: F vs G Fund

I'll be corrected if I 'm off base here. My understanding is that the "G" fund are government bonds that have a fixed rate set by the Treasury. The "F" fund is a grouping of long term and short term bonds (3 year and 10 year as an example) that are traded on the open market and causes their price to vary daily.

Can someone explain how and when one should choose F fund over G fund? Don't understand F fund very well but hate to just park in G fund if there is some potential in F fund. Especially during this crazy crisis that involves government stimulus and possibility of deflation economy. Thx in advance

I'll be corrected if I 'm off base here. My understanding is that the "G" fund are government bonds that have a fixed rate set by the Treasury. The "F" fund is a grouping of long term and short term bonds (3 year and 10 year as an example) that are traded on the open market and causes their price to vary daily.

nnuut

Moderator | TSP Talk Royalty

- Reaction score

- 210

Re: F vs G Fund

This is on the TSP Site.

[video=youtube;06-e962mWyA]https://www.youtube.com/watch?time_continue=52&v=06-e962mWyA&feature=emb_logo[/video]

[video=youtube;OHdIdwS33uA]https://www.youtube.com/watch?time_continue=1&v=OHdIdwS33uA&feature=emb_lo go[/video]

This is on the TSP Site.

[video=youtube;06-e962mWyA]https://www.youtube.com/watch?time_continue=52&v=06-e962mWyA&feature=emb_logo[/video]

[video=youtube;OHdIdwS33uA]https://www.youtube.com/watch?time_continue=1&v=OHdIdwS33uA&feature=emb_lo go[/video]

James48843

TSP Talk Royalty

- Reaction score

- 943

Eleee325 - For me, I like to use the “F” instead of the “G” when we are in a general period of falling interest rates, as it appears to me that the F performs better that the G in those times.

One word of caution- that at times of crazy uncertainty over market direction and instability, the “F” fund doesn’t always act the way you would expect it, as sometimes large flows of money into and out of those bonds, can adversely affect the value/pricing of the shares. I’ve gotten my fingers slapped several times over the years when those interest rates SHOULD have produced a nice expected gain for me, and then I realize I’ve been had after the bell, when the TSP prices it at something other than what made sense to me.

If you are looking for safety, stick with the G.

If you are looking for better performance, then do everything you can to understand what stocks make up each of the C, S, and I funds, and the bonds underlying the F fund.

Best of luck to you- because sometimes, luck can play into the mix too.

“If it weren’t for bad luck, I’d have no luck at all. Gloom, despair, and agony on me. “

Sent from my iPhone using TSP Talk Forums

One word of caution- that at times of crazy uncertainty over market direction and instability, the “F” fund doesn’t always act the way you would expect it, as sometimes large flows of money into and out of those bonds, can adversely affect the value/pricing of the shares. I’ve gotten my fingers slapped several times over the years when those interest rates SHOULD have produced a nice expected gain for me, and then I realize I’ve been had after the bell, when the TSP prices it at something other than what made sense to me.

If you are looking for safety, stick with the G.

If you are looking for better performance, then do everything you can to understand what stocks make up each of the C, S, and I funds, and the bonds underlying the F fund.

Best of luck to you- because sometimes, luck can play into the mix too.

“If it weren’t for bad luck, I’d have no luck at all. Gloom, despair, and agony on me. “

Sent from my iPhone using TSP Talk Forums

James48843

TSP Talk Royalty

- Reaction score

- 943

THINGS THAT MAKE YOU GO Hmmm...

Yesterday the AGG was up about 3 cents- but the "F" fund actually dropped a half a penny/

Somebody is holding back those 3 cents..... (maybe? ) .

let's see if they make it up today.

Best of luck.

Yesterday the AGG was up about 3 cents- but the "F" fund actually dropped a half a penny/

Somebody is holding back those 3 cents..... (maybe? ) .

let's see if they make it up today.

Best of luck.

- Reaction score

- 2,577

- Reaction score

- 574

Bonds were overtaking the money inflow over equities and money markets in the week up to August 4th. This was the greatest money inflow in four week for U.S. bonds. Bonds had a quarter percent gain for the week going after the 4th but gave up most of the gains yesterday and gapped down further today.

- Reaction score

- 2,577

Treasury yields fall, prices climb as investors seek shelter from stock sell-off

https://www.cnbc.com/2022/05/19/us-bonds-treasury-prices-climb-following-stock-market-sell-off.html

The yield on the benchmark 10-year Treasury note fell 11 basis points to 2.778% at 9 a.m. ET. The yield on the 30-year Treasury bond moved 9 basis points lower to 2.983%. Yields move inversely to prices, and 1 basis point is equal to 0.01%.

https://www.cnbc.com/2022/05/19/us-bonds-treasury-prices-climb-following-stock-market-sell-off.html

- Reaction score

- 2,577

Double top in the 10-year yield is starting to pullback - although it's early. I think at some point soon investors will start looking to bonds while stocks deal with the issues of the economy. As yields pull back, bonds and the F-fund could get a bounce.

- Reaction score

- 574

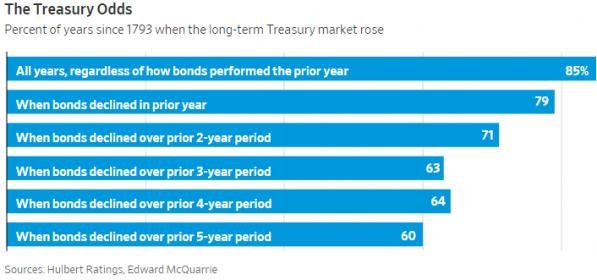

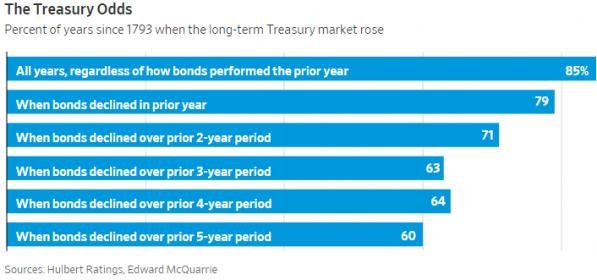

The F-fund has rebounded some in the last month, but its trend through 2022 has been strongly negative. This Wall Street Journal article looks at how bonds performed the year following a negative year. The main point they make is the trend of the year has an impact. Although bond markets have bounced back following a negative year 79% of the time since 1793, that percentage would be closer to 85% if the trend had no impact from one year to the next.

Bonds Are Primed for a Better 2023, but How Much Better?

Bonds Are Primed for a Better 2023, but How Much Better?

- Reaction score

- 574

Re: F vs G Fund

The bond market lost its grip today. The bond ETF BND (F-fund) lost more than 1% today while U.S. stock indices closed within 0.1% of Friday's price. The difference in price range is counter to what you'd expect between stocks and bonds. U.S. Treasury issued bonds are typically thought to be a safer bet and less volatile than stocks. In normal economic conditions, the assurance of the U.S. government to pay back bond holders keeps yields (and thus bond prices) relatively stable.

But now the validity of that assurance is dwindling. Today Janet Yellen warned the U.S. may be unable to pay all of its obligations as soon as June 1st. Without an increase in the debt limit, the U.S. could default on debt for the first time. The country's ability to pay its debt is the foundation of what makes the U.S. economy a world economic powerhouse. There is little hope as of now coming out of congress that the issue will be resolved soon with both parties strong opposing the other. This is not the only matter threatening the stability of the bond market but is coupled with high inflation, a hawkish Fed, and other economic worries.

Now we are seeing an atypically volatile bond market. But it doesn't look like it is all one direction. The ETF BND (F-fund) price has bounced in a trading range established over the last month and a half. Today's 1% loss put the price at the bottom of that trading channel which is held by its 50 and 200-day EMAs as support. What may look like a buying opportunity for the excited bond market is not grabbing TSP Talk members' attentions. Only 3.25% of allocations among non-premium TSP Talk AutoTracker members are in the F-fund. And after a 1% drop today, not a single member bought into the F-fund today.

[h=1]Treasury Chief Janet Yellen Says U.S. Risks Default as Soon as June 1 Without Debt Ceiling Increase[/h]

The bond market lost its grip today. The bond ETF BND (F-fund) lost more than 1% today while U.S. stock indices closed within 0.1% of Friday's price. The difference in price range is counter to what you'd expect between stocks and bonds. U.S. Treasury issued bonds are typically thought to be a safer bet and less volatile than stocks. In normal economic conditions, the assurance of the U.S. government to pay back bond holders keeps yields (and thus bond prices) relatively stable.

But now the validity of that assurance is dwindling. Today Janet Yellen warned the U.S. may be unable to pay all of its obligations as soon as June 1st. Without an increase in the debt limit, the U.S. could default on debt for the first time. The country's ability to pay its debt is the foundation of what makes the U.S. economy a world economic powerhouse. There is little hope as of now coming out of congress that the issue will be resolved soon with both parties strong opposing the other. This is not the only matter threatening the stability of the bond market but is coupled with high inflation, a hawkish Fed, and other economic worries.

Now we are seeing an atypically volatile bond market. But it doesn't look like it is all one direction. The ETF BND (F-fund) price has bounced in a trading range established over the last month and a half. Today's 1% loss put the price at the bottom of that trading channel which is held by its 50 and 200-day EMAs as support. What may look like a buying opportunity for the excited bond market is not grabbing TSP Talk members' attentions. Only 3.25% of allocations among non-premium TSP Talk AutoTracker members are in the F-fund. And after a 1% drop today, not a single member bought into the F-fund today.

[h=1]Treasury Chief Janet Yellen Says U.S. Risks Default as Soon as June 1 Without Debt Ceiling Increase[/h]

- Reaction score

- 574

Re: F vs G Fund

We are eleven days closer to Janet Yellen's warning of a potential U.S. default on debt and congress is still playing chicken with the debt-ceiling. Meanwhile, yields have fallen in the last eleven days. What's happening here?

The bond market has other factors outside of politics to thank. The stress in regional banks has been a boost for bond prices and the F-fund. But I can't tell if the market is being too dismissive to the possibility of a default. It is something that has not happened in the U.S. before so I wonder if there may be a naivety to the impact it would have on the entire economy. Of course, the market is smarter than any single person, but it reminds me of the calm trading we saw in the days leading up to the Covid crash of 2020. Covid was very much in the news and headlines were warning of the worst, but the market didn't take the warnings seriously until the virus was confirmed to be in the United States. Are we seeing a similar disconnect in the bond market today? Or are headlines, talking heads, and politicians over escalating the threat?

Here BND, an ETF that follows the 10-year Treasury bond market (F-fund):

Here are the 10-year Treasury yields:

We are eleven days closer to Janet Yellen's warning of a potential U.S. default on debt and congress is still playing chicken with the debt-ceiling. Meanwhile, yields have fallen in the last eleven days. What's happening here?

The bond market has other factors outside of politics to thank. The stress in regional banks has been a boost for bond prices and the F-fund. But I can't tell if the market is being too dismissive to the possibility of a default. It is something that has not happened in the U.S. before so I wonder if there may be a naivety to the impact it would have on the entire economy. Of course, the market is smarter than any single person, but it reminds me of the calm trading we saw in the days leading up to the Covid crash of 2020. Covid was very much in the news and headlines were warning of the worst, but the market didn't take the warnings seriously until the virus was confirmed to be in the United States. Are we seeing a similar disconnect in the bond market today? Or are headlines, talking heads, and politicians over escalating the threat?

Here BND, an ETF that follows the 10-year Treasury bond market (F-fund):

Here are the 10-year Treasury yields:

- Reaction score

- 2,577

Re: F vs G Fund

Good stuff! Although I always wondered when the bond market "knew" what was going on with COVID. In early 2020 or was it even earlier? Yields were sliding for a long time even before that decline in August of 2019.

Its traders are a lot more savvy than the typical stock investor.

Good stuff! Although I always wondered when the bond market "knew" what was going on with COVID. In early 2020 or was it even earlier? Yields were sliding for a long time even before that decline in August of 2019.

Its traders are a lot more savvy than the typical stock investor.

Similar threads

- Replies

- 0

- Views

- 88

- Replies

- 0

- Views

- 176