-

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

-

Please read our AutoTracker policy on the IFT deadline and remaining active. Thanks!

-

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

-

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Epic's Account Talk

- Thread starter Epic

- Start date

Epic

TSP Pro

- Reaction score

- 365

Epic

TSP Pro

- Reaction score

- 365

Whelp.....THAT didn't work out very well at all. FU JPow. U ruined X-mas.

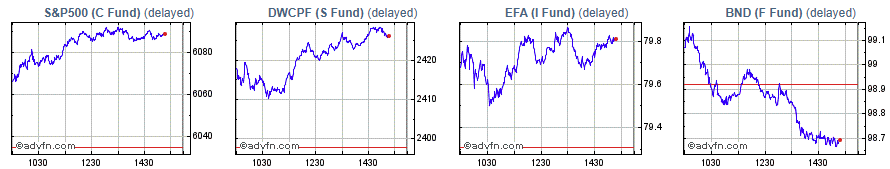

Going back to 100% G-fund. I'm a smidge down for Dec., but not by much. Good thing I played it conservative and just went 15%C and 5%S, but now I'm back to 100% G.

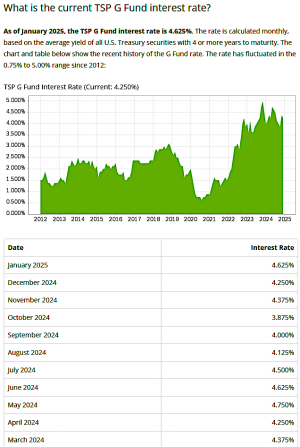

Treasuries as of right now are looking good for the last day of the month, so we should get a tick UP in the G-fund from Dec. and into Jan 2025, and that's just fine with me. Anything over 4% in G, and I'm pulling in a decent monthly amount wit ZERO risk, and peace of mind.

The 10, 20, and 30 are all above 4.5%, with the 20 and 30 just below 5%. That aint bad at all. I'll take it and wait for a better time to try and enter.

Most talking heads are leery of the first half being a bit sketchy going into 2025, so I'll hide out for a bit and keep an eye on things.

Should be interesting to see if Jan 20th (National Freedom Day) catapults the Market to the moon, or creates massive volatility with all the new ways of doing things (tariffs and such). I'll be happy to watch from the side trying to figure it all out in safety, thank you very much.

BEST of LUCK to everyone here. Wishing all of you a very profitable 2025. LETS GO ! ! ! ! !

https://www.cnbc.com/bonds/

.....

Going back to 100% G-fund. I'm a smidge down for Dec., but not by much. Good thing I played it conservative and just went 15%C and 5%S, but now I'm back to 100% G.

Treasuries as of right now are looking good for the last day of the month, so we should get a tick UP in the G-fund from Dec. and into Jan 2025, and that's just fine with me. Anything over 4% in G, and I'm pulling in a decent monthly amount wit ZERO risk, and peace of mind.

The 10, 20, and 30 are all above 4.5%, with the 20 and 30 just below 5%. That aint bad at all. I'll take it and wait for a better time to try and enter.

Most talking heads are leery of the first half being a bit sketchy going into 2025, so I'll hide out for a bit and keep an eye on things.

Should be interesting to see if Jan 20th (National Freedom Day) catapults the Market to the moon, or creates massive volatility with all the new ways of doing things (tariffs and such). I'll be happy to watch from the side trying to figure it all out in safety, thank you very much.

BEST of LUCK to everyone here. Wishing all of you a very profitable 2025. LETS GO ! ! ! ! !

https://www.cnbc.com/bonds/

.....

Last edited:

WorkFE

TSP Legend

- Reaction score

- 523

4.6254.6%, not too shabby.

Don't be cheating me out of my pennies.

Epic

TSP Pro

- Reaction score

- 365

In case anyone's interested in watching anything from DAVOS 2025.

The World Economic Forum is the international organization committed to improving the state of the world through public-private cooperation in the spirit of global citizenship.

HERE > > > > https://www.youtube.com/@wef/streams

The World Economic Forum is the international organization committed to improving the state of the world through public-private cooperation in the spirit of global citizenship.

HERE > > > > https://www.youtube.com/@wef/streams

Epic

TSP Pro

- Reaction score

- 365

I'm never really sure where to post stuff like this 'cause it doesn't really fit into any of the categories. It's just more of a general information thing that may help others as I was not sure myself. I will explain  :

:

So, I have a separate Stock Account (Fidelity), and it's linked to my Bank, but sometimes I don't want to draw from that, so I was wondering if I could make a one time withdraw from my TSP (say like 10 or 20K) to feed my Fidelity Account. I've never so much as ever taken 1 penny from my TSP, so I wasn't sure. The short answer that I found is "YES".

In looking into this, I ran across this video. He explains the different options of moving your money should you want to, for whatever reason. It's not longwinded at all. It's short and to the point (only 9 minutes long). I found it to be pretty helpful. Maybe someone else might as well.

It's only a year old, so I'd assume the info is still current.

So, I have a separate Stock Account (Fidelity), and it's linked to my Bank, but sometimes I don't want to draw from that, so I was wondering if I could make a one time withdraw from my TSP (say like 10 or 20K) to feed my Fidelity Account. I've never so much as ever taken 1 penny from my TSP, so I wasn't sure. The short answer that I found is "YES".

In looking into this, I ran across this video. He explains the different options of moving your money should you want to, for whatever reason. It's not longwinded at all. It's short and to the point (only 9 minutes long). I found it to be pretty helpful. Maybe someone else might as well.

It's only a year old, so I'd assume the info is still current.

- Reaction score

- 857

I have made a onetime partial withdrawal from my TSP account years ago when I retired the first time. I had it sent to me and of course I had to pay taxes on it come tax time.I'm never really sure where to post stuff like this 'cause it doesn't really fit into any of the categories. It's just more of a general information thing that may help others as I was not sure myself. I will explain:

So, I have a separate Stock Account (Fidelity), and it's linked to my Bank, but sometimes I don't want to draw from that, so I was wondering if I could make a one time withdraw from my TSP (say like 10 or 20K) to feed my Fidelity Account. I've never so much as ever taken 1 penny from my TSP, so I wasn't sure. The short answer that I found is "YES".

In looking into this, I ran across this video. He explains the different options of moving your money should you want to, for whatever reason. It's not longwinded at all. It's short and to the point (only 9 minutes long). I found it to be pretty helpful. Maybe someone else might as well.

It's only a year old, so I'd assume the info is still current.

In December I did a transfer of all my TSP to my Edward Jones account. The one thing with that was I had to have my Edward Jones information in my TSP account at least 7 days before I could start the process. Also, the money is sent in a check by snail mail.

I'm not 100% sure but I think you can make a partial withdrawal and send it right to Fidelity. If I'm wrong evilanne will correct me.

Epic

TSP Pro

- Reaction score

- 365

I'm not sure myself, but that's a great thought. I'll have to check it out.I'm not 100% sure but I think you can make a partial withdrawal and send it right to Fidelity. If I'm wrong evilanne will correct me.

I like to keep my Savings at a certain level just for Emergency liquid funds if I need it, but the Market is primed right now for some profitable investing, so having another source such as a one time Partial withdraw from TSP would be a good option.

Thanks !!!

- Reaction score

- 857

I know if you make a partial withdrawal to you there is no age limit. But from a commercial that runs on local tv I'm pretty sure he talks about 59 1/2 and you can transfer up to 90% of your TSP account to a 401K account. So, it would probably be a transfer not a partial withdrawal to your Fidelity account. If that commercial comes back on, I'll pay more attention.I'm not sure myself, but that's a great thought. I'll have to check it out.

I like to keep my Savings at a certain level just for Emergency liquid funds if I need it, but the Market is primed right now for some profitable investing, so having another source such as a one time Partial withdraw from TSP would be a good option.

Thanks !!!

Epic

TSP Pro

- Reaction score

- 365

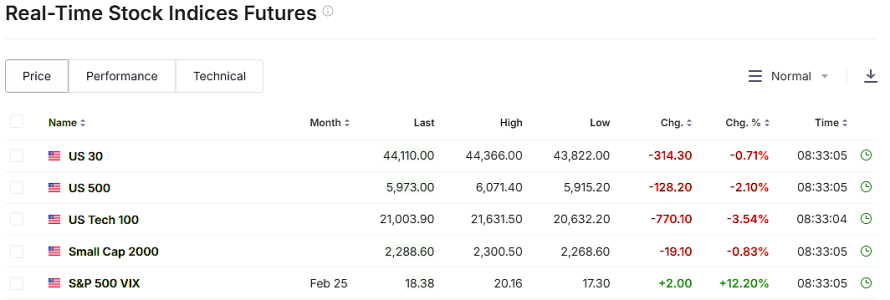

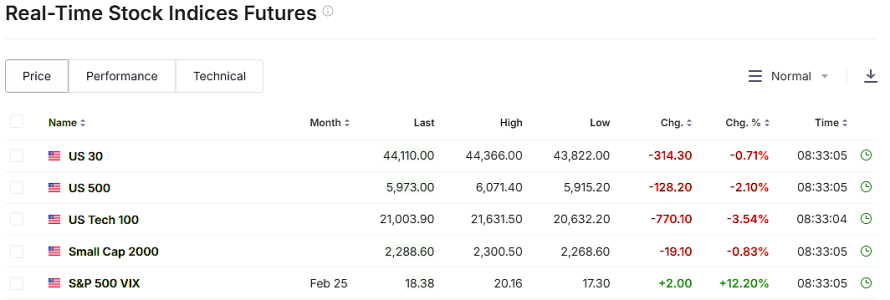

Futures not good.

Is this all related to DEEPSEEK from China???

I heard that Deepseek model was build on top of Llama (meta) using entirely Nvidia´s H800 chip systems.

I don't trust it (open source), but it's kickin the markets ass at the moment.

Good luck everybody. Happy Monday...I'm goin back to bed.... LOL

https://www.investopedia.com/tech-stocks-sinking-on-deepseek-threat-8780706

Is this all related to DEEPSEEK from China???

I heard that Deepseek model was build on top of Llama (meta) using entirely Nvidia´s H800 chip systems.

I don't trust it (open source), but it's kickin the markets ass at the moment.

Good luck everybody. Happy Monday...I'm goin back to bed.... LOL

https://www.investopedia.com/tech-stocks-sinking-on-deepseek-threat-8780706

Epic

TSP Pro

- Reaction score

- 365

I hear ya.Meanwhile, the Fidelity Government Money Market (SPAXX)'s yield is a mere 4.07%.

I'm fully invested in my Fidelity Account, with no money left to play as I took a nasty hit from the market DEEPSEEK freak-out.

Things are coming back, so I just need to be patient.

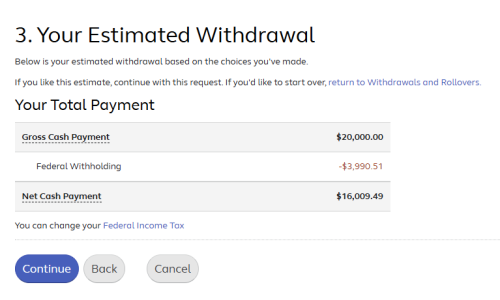

Still on the fence about taking a "one time" partial withdraw of 20K (from TSP) to feed my Fidelity Account. If you request 20K, they withhold 4K for taxes. I haven't done it yet, but I might. Still contemplating.

Also......watching this vid series on Options Trading and trying to educate myself. It seems dam complicated, and I have no confidence in myself as of yet, but I want to at least try one or two (small / low $$ amount) Options trades just to see how things work out.

I'll probably screw it up somehow and lose money, but I at least want to give it a try as soon as I learn what the hell I'm doing. LOL

11 short vids in all:

...

- Reaction score

- 573

Still on the fence about taking a "one time" partial withdraw of 20K (from TSP) to feed my Fidelity Account. If you request 20K, they withhold 4K for taxes. I haven't done it yet, but I might. Still contemplating.

Well, if your goal as an investor is to not lose money, then keeping it in the TSP instead of taking the instant loss would be the choice. You would be starting that money with a nearly 20% loss to begin with in Fidelity. That would be a very bad year for even holding all of that money in the C-fund, but the C-fund also has a chance of increasing in that time. (Not a suggestion, just an example)

Similar threads

- Replies

- 0

- Views

- 96

- Replies

- 1

- Views

- 245

- Replies

- 0

- Views

- 196