Just yesterday the seven sentinels issued an unconfirmed buy signal, and in my blog I stated that these signals, whether confirmed or unconfirmed, were typically happening near turning points in the market. So it would appear resistance has held once again and we are now heading back down to test support. So many opportunities. So few IFTs.

There wasn't much to drive the markets today, and that was the reason some media outlets were using to explain today's weakness.

Gotta be a reason for everything, right?

Here's the charts:

NAMO and NYMO are back below the neutral line and have flipped to sells in the process.

NAHL and NYHL dipped just a bit lower, but maintained their buy status.

TRIN and TRINQ both spiked higher today (especially TRIN) and are highly suggestive of a short term oversold market. Ordinarily, I'd expect some buying pressure tomorrow based on these two charts, but I'm thinking even if we get it, there's a good chance it doesn't hold through the day.

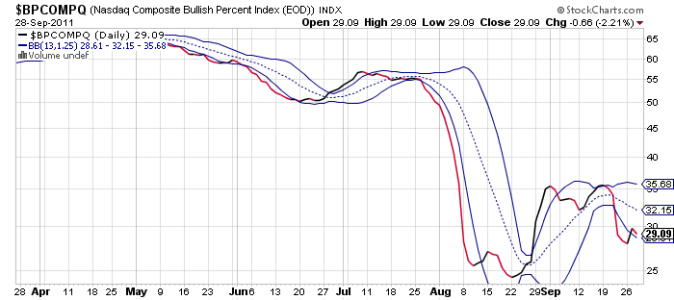

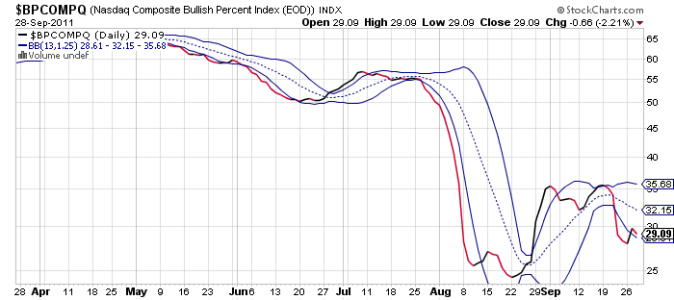

BPCOMPQ turned back down today, but did manage to retain its buy status.

So the signals are mixed again after issuing an unconfirmed buy signal yesterday. But remember, the official signal is still in a sell condition. I'm not sure just how important that is the way this market is acting. There's no intermediate term trend. Only hard, fast action that's whipsawing signals.

But sooner or later this market is going to breakout. Whether it's to the upside or downside remains to be seen. And a case can be made for either. I'm looking lower myself, but shorting activity is still robust enough to keep this market bouyant. But that's not a guarantee that this market can't breakout to the downside. Only that in normal markets it probably wouldn't. But this market isn't normal, so care must be taken by those less inclined to risk.

I was hoping to see the F fund turn higher after three heavy days of selling pressure, but it fell a bit more today, although less than previous days. I'm still holding 100% F fund and looking to sell into a bond rally. Preferably by the end of this week, but there's not much time left now. I could also hold this position into October and look for an entry point directly into stocks from the F fund. At least that way I'm maximizing my IFTs. We'll have to see how it plays out, but I'm not liking the fact that it didn't bounce even while stocks were selling off. That may not be completely unusual, but ever since the Fed began Operation Twist I am mindful that game may be changing. That still remains to be seen, but I'm watching it carefully now.

There wasn't much to drive the markets today, and that was the reason some media outlets were using to explain today's weakness.

Gotta be a reason for everything, right?

Here's the charts:

NAMO and NYMO are back below the neutral line and have flipped to sells in the process.

NAHL and NYHL dipped just a bit lower, but maintained their buy status.

TRIN and TRINQ both spiked higher today (especially TRIN) and are highly suggestive of a short term oversold market. Ordinarily, I'd expect some buying pressure tomorrow based on these two charts, but I'm thinking even if we get it, there's a good chance it doesn't hold through the day.

BPCOMPQ turned back down today, but did manage to retain its buy status.

So the signals are mixed again after issuing an unconfirmed buy signal yesterday. But remember, the official signal is still in a sell condition. I'm not sure just how important that is the way this market is acting. There's no intermediate term trend. Only hard, fast action that's whipsawing signals.

But sooner or later this market is going to breakout. Whether it's to the upside or downside remains to be seen. And a case can be made for either. I'm looking lower myself, but shorting activity is still robust enough to keep this market bouyant. But that's not a guarantee that this market can't breakout to the downside. Only that in normal markets it probably wouldn't. But this market isn't normal, so care must be taken by those less inclined to risk.

I was hoping to see the F fund turn higher after three heavy days of selling pressure, but it fell a bit more today, although less than previous days. I'm still holding 100% F fund and looking to sell into a bond rally. Preferably by the end of this week, but there's not much time left now. I could also hold this position into October and look for an entry point directly into stocks from the F fund. At least that way I'm maximizing my IFTs. We'll have to see how it plays out, but I'm not liking the fact that it didn't bounce even while stocks were selling off. That may not be completely unusual, but ever since the Fed began Operation Twist I am mindful that game may be changing. That still remains to be seen, but I'm watching it carefully now.