The broader market traded in volatile fashion in the morning session and by noon was near the flat line. From there it chopped its way lower with the S&P closing out today's trading with a 0.14% loss, while the Wilshire 4500 posted a more moderate 0.36% loss. The Nasdaq fared a bit worse with a 0.51% loss, but even that wasn't as bad as it could have been.

Not surprisingly, oil was the main focus today in a market largely devoid of catalysts. At the close oil had traded down with a 0.6% loss, which left a barrel of oil a bit North of the $104 mark.

Here's today's charts:

NAMO and NYMO both flipped back to sells.

NAHL remained on a sell, while NYHL managed to flip to a buy.

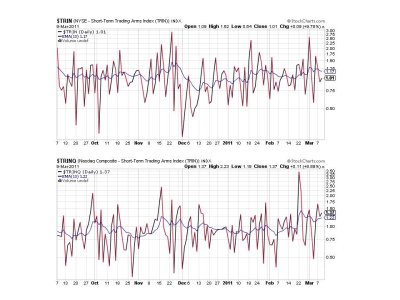

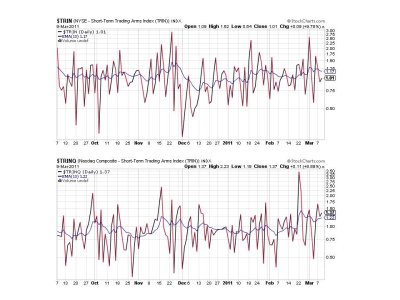

TRIN remained on a buy, while TRINQ remained on a sell.

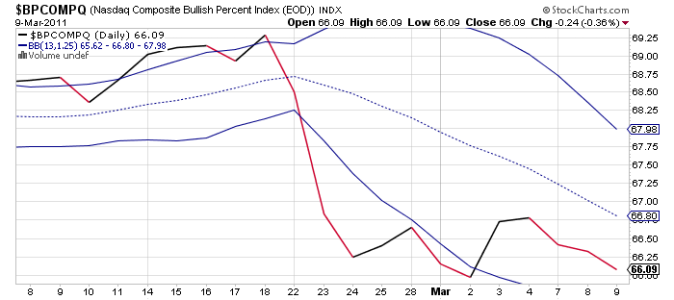

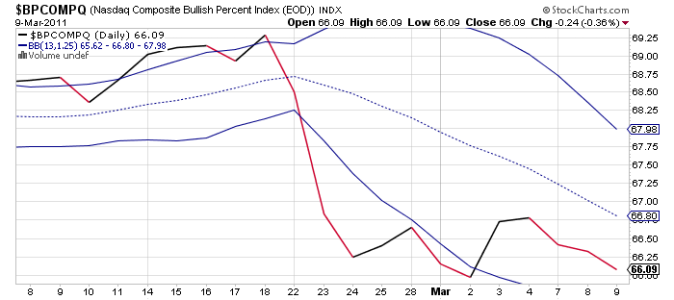

BPCOMPQ ebbed just a bit lower, but remains on a buy.

So the signals stay mixed, but the Seven Sentinels remain on a buy, although there is a down bias to this market. The problem is that this market is oscillating in a range and it could break out either way with a given catalyst. The system says buy, but the bias is lower. So far my expectation for QE2 to limit the downside seems to a correct assumption, but where will the bottom finally be? I am still holding a 50% G fund and 50% stock allocation until this market decides which way it's going to go.

Not surprisingly, oil was the main focus today in a market largely devoid of catalysts. At the close oil had traded down with a 0.6% loss, which left a barrel of oil a bit North of the $104 mark.

Here's today's charts:

NAMO and NYMO both flipped back to sells.

NAHL remained on a sell, while NYHL managed to flip to a buy.

TRIN remained on a buy, while TRINQ remained on a sell.

BPCOMPQ ebbed just a bit lower, but remains on a buy.

So the signals stay mixed, but the Seven Sentinels remain on a buy, although there is a down bias to this market. The problem is that this market is oscillating in a range and it could break out either way with a given catalyst. The system says buy, but the bias is lower. So far my expectation for QE2 to limit the downside seems to a correct assumption, but where will the bottom finally be? I am still holding a 50% G fund and 50% stock allocation until this market decides which way it's going to go.