It was another up/down day in the market, or perhaps I should say down/up, as stocks started out weaker and chopped their way higher by the close, finishing mixed overall.

This morning's data releases saw the Philadelphia Fed Index for July drop unexpectedly from an anticipated 10.1 to an actual reading of 5.1. Initial jobless claims were lower-than-expected, but continuing jobless claims saw a steep rise over consensus estimates. The Empire Manufacturing Index and industrial production numbers were very close to consensus. PPI was up sharply, while core PPI was in-line with estimates.

Overall it wasn't a good day from an economic data perspective, but should we be surprised?

The financial sector had some news today, as JPMorgan posted better-than-expected earnings, while the SEC confirmed in a press release that Goldman Sachs will pay $550 million to settle charges related to the subprime mortgage CDO charges.

Perhaps the biggest news is still being evaluated. BP's stock jumped as reports indicated that the Gulf oil leak has stopped. Tests are continuing however.

The Euro surged 1.6% against the dollar to set a new two-month high. That's what kept the I fund afloat today.

But the euro's strength did nothing to prevent Europe’s major bourses from selling off.

So a lot of news and data hit the market today, some good, some not so good.

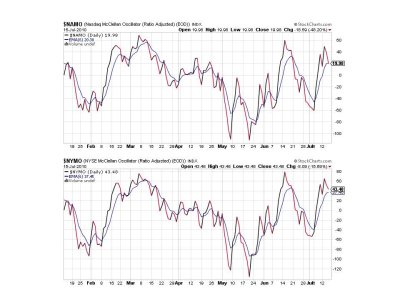

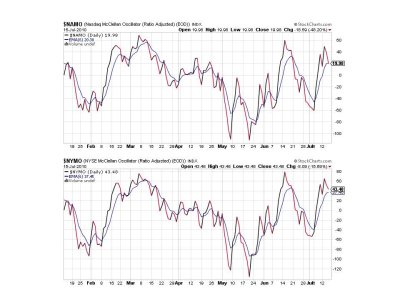

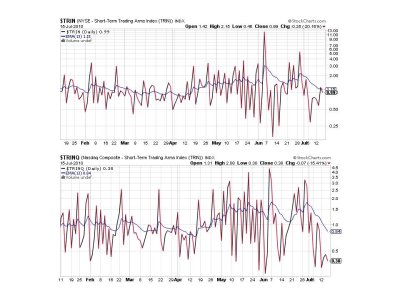

And the Seven Sentinels? All seven signals are flashing buys again. But the signals are moderating as this market has hit a wall the past two trading days. Here's the charts:

Still a buys here, but both signals are very close to their 6 day EMAs. At this point I'm not concerned as this is OPEX and we were due for a pause at the very least.

Same here.

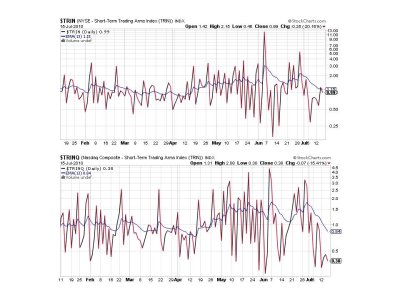

TRIN managed to flip back to a buy today, while TRINQ remained on a buy and has been on a buy for 10 straight trading days. That's a little unusual considering the volatility.

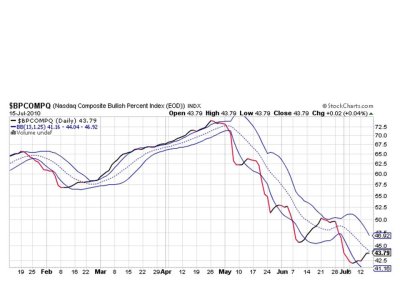

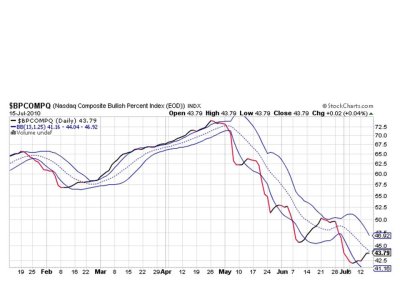

Finally, BPCOMPQ moved sideways and finds itself close to center with the bollies.

So again, all seven signals are on buys, which keeps the system on a buy.

More weakness may be coming, or not depending on the BP situation, OPEX, and any surprise market data or news. The market could go either way, but sentiment favors up. I believe it is just a matter of time before we break resistance and head higher. I'm thinking it'll happen sometime next week.

Still 100% S fund. See you tomorrow.

This morning's data releases saw the Philadelphia Fed Index for July drop unexpectedly from an anticipated 10.1 to an actual reading of 5.1. Initial jobless claims were lower-than-expected, but continuing jobless claims saw a steep rise over consensus estimates. The Empire Manufacturing Index and industrial production numbers were very close to consensus. PPI was up sharply, while core PPI was in-line with estimates.

Overall it wasn't a good day from an economic data perspective, but should we be surprised?

The financial sector had some news today, as JPMorgan posted better-than-expected earnings, while the SEC confirmed in a press release that Goldman Sachs will pay $550 million to settle charges related to the subprime mortgage CDO charges.

Perhaps the biggest news is still being evaluated. BP's stock jumped as reports indicated that the Gulf oil leak has stopped. Tests are continuing however.

The Euro surged 1.6% against the dollar to set a new two-month high. That's what kept the I fund afloat today.

But the euro's strength did nothing to prevent Europe’s major bourses from selling off.

So a lot of news and data hit the market today, some good, some not so good.

And the Seven Sentinels? All seven signals are flashing buys again. But the signals are moderating as this market has hit a wall the past two trading days. Here's the charts:

Still a buys here, but both signals are very close to their 6 day EMAs. At this point I'm not concerned as this is OPEX and we were due for a pause at the very least.

Same here.

TRIN managed to flip back to a buy today, while TRINQ remained on a buy and has been on a buy for 10 straight trading days. That's a little unusual considering the volatility.

Finally, BPCOMPQ moved sideways and finds itself close to center with the bollies.

So again, all seven signals are on buys, which keeps the system on a buy.

More weakness may be coming, or not depending on the BP situation, OPEX, and any surprise market data or news. The market could go either way, but sentiment favors up. I believe it is just a matter of time before we break resistance and head higher. I'm thinking it'll happen sometime next week.

Still 100% S fund. See you tomorrow.