DreamboatAnnie

TSP Legend

- Reaction score

- 854

Hi Shitepoke,

You might be in good shape with entry set for December :smile: even though futures are down right now.

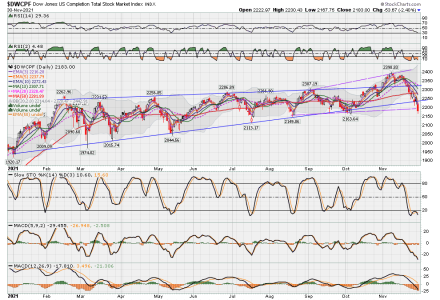

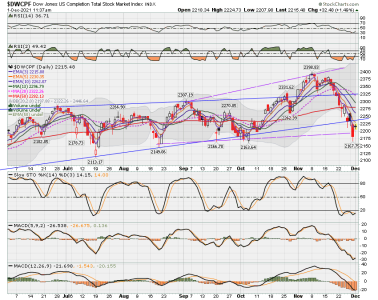

A major part of my entry strategy is to enter preferably after Slow Stochastic has dropped below 20, and begins to rise so it crosses back up above its signal line or preferably is crossing back up above 20. An entry when it only crosses above its signal line is an early entry and riskier than waiting for the signal line to cross back up above 20. The fear is whether it has finished its drop to avoid the falling knife.

Once I enter, I like to see the Stochastic line rising at a sharp upward angle and for MACD default (setting at 12,26,9) to rise above its signal line within 3 days after entry. To me these two characteristics indicate a strong thrust up that may last awhile even after it gets above 80 on Slow Sto. But if those characteristics don't occur, I consider this a weak upthrust that may reverse as soon as signal line touches 80 on Slow Stochastic, or reverse via whipsaw even sooner. Obviously, these scenarios do not always play out, but they happen often enough to where I have some confidence in them and weigh them in my decision making.

I also look at trendlines and candle patterns to make decision on entry, plus look at weekly charts.

Now for the UGLY: I try to manage my two IFTs if at month's end. I don't like to enter on last day of month just to set up my IFTs for the next month, but I may do that tomorrow. It might be a little early for entry (per reading of Stochastics), but first part of month often makes money if financial info on 1st and 3rd day of month are good, plus on first Friday we get job numbers. So, if you start the month in the market, you might be able to exit to pocket some gains and still have the 2nd IFT left to reenter if market drops back down before end of month.

I think the exits are harder to time and can be costly.

Best wishes to you! :smile:

You might be in good shape with entry set for December :smile: even though futures are down right now.

A major part of my entry strategy is to enter preferably after Slow Stochastic has dropped below 20, and begins to rise so it crosses back up above its signal line or preferably is crossing back up above 20. An entry when it only crosses above its signal line is an early entry and riskier than waiting for the signal line to cross back up above 20. The fear is whether it has finished its drop to avoid the falling knife.

Once I enter, I like to see the Stochastic line rising at a sharp upward angle and for MACD default (setting at 12,26,9) to rise above its signal line within 3 days after entry. To me these two characteristics indicate a strong thrust up that may last awhile even after it gets above 80 on Slow Sto. But if those characteristics don't occur, I consider this a weak upthrust that may reverse as soon as signal line touches 80 on Slow Stochastic, or reverse via whipsaw even sooner. Obviously, these scenarios do not always play out, but they happen often enough to where I have some confidence in them and weigh them in my decision making.

I also look at trendlines and candle patterns to make decision on entry, plus look at weekly charts.

Now for the UGLY: I try to manage my two IFTs if at month's end. I don't like to enter on last day of month just to set up my IFTs for the next month, but I may do that tomorrow. It might be a little early for entry (per reading of Stochastics), but first part of month often makes money if financial info on 1st and 3rd day of month are good, plus on first Friday we get job numbers. So, if you start the month in the market, you might be able to exit to pocket some gains and still have the 2nd IFT left to reenter if market drops back down before end of month.

I think the exits are harder to time and can be costly.

Best wishes to you! :smile:

Last edited: