DreamboatAnnie

TSP Legend

- Reaction score

- 785

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com ...

Or you can now use TapaTalk again!

Hi Quabit, I feel for you. Losses are tough to take. Word of caution--- set your loss limit and execute an exit if you hit it.

Riding it down seems okay until fear sets in. Some have taken that view and dug a deep hole that is very difficult to come back from, and we have had some lose in excess of 10-20% over multiple transactions. Others say as long as you do not sell, the loss is not booked. This is true if you have the guts to see it drop a lot, do not exit and if we do not go into hard downturn and market recovers fairly quick.

I know myself well enough to know I am awful at dropping more than a few percent. So, my hands down stop/exit is at a loss of about 3% on a trade, and under no circumstance will I stay in with a TSP drop below 0% for the year without immediately exiting (which is more likely at start of year when gains have not yet accumulated).

even though I know it could end up like yesterday

even though I know it could end up like yesterdayS fund Looking much better. :smile:

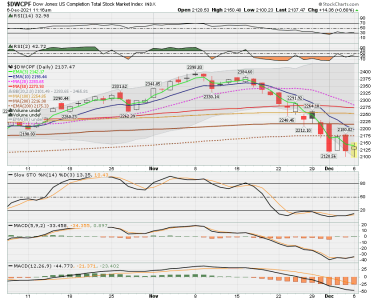

Dead Cat bounce? One big move up and one bigger move back. I don’t know but will see what tomorrow brings. 路* I don’t like the chart on $DWCPF at the moment.

Tommy IV, great point about 200 EMA acting as resistance. For the moment, the low is above Monday's close...barely. Will see how it goes rest of day and into next week. I added in 200 EMA and 200 SMA to these charts.

Charts as of a few mins ago. Sticky pants deployed for now. Wishing you all a great weekend! :smile:

View attachment 52117

View attachment 52118

View attachment 52119

View attachment 52120

Hummm...Looks like a big happy cat swinging on my tree! Futures are up! :laugh: Maybe we are in for a wild ride...

View attachment 52140

Getting than uneasy feeling. Like I have not felt in years. Like when Darth Vadar was talking about Obi Wan feeling. Yes I remember…the beginning of the market collapse. Huge swings begin the onslaught to faster downside and trapped investors. I may need to order some of those sticky pants if I make a misstep.