- Reaction score

- 2,496

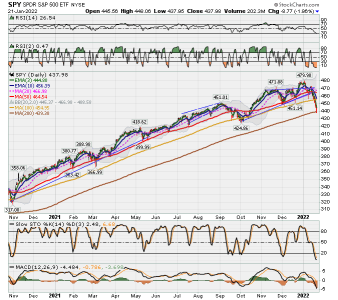

This is the first time I have ever watched the market go down like this. I am assuming things could get a lot worse.

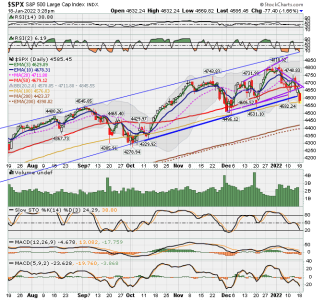

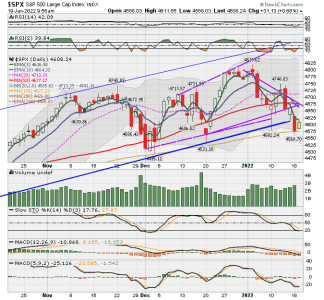

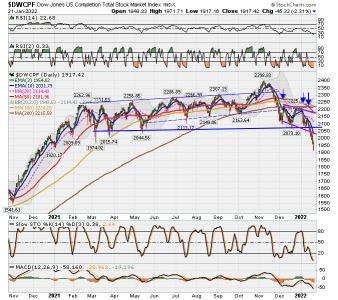

I'm totally not saying that this IS what is going to happen, just what is possible just looking back at the COVID crash. Today we are seeing the first cracks in the S&P's intermediate term uptrend - something that happened in Feb. 2020. Small caps have done this a while back.