DreamboatAnnie

TSP Legend

- Reaction score

- 854

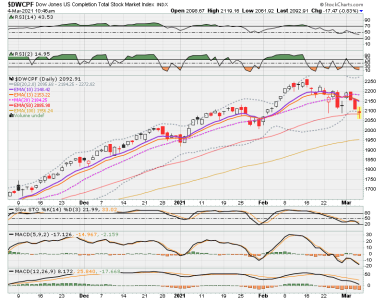

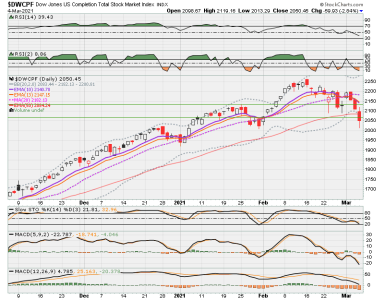

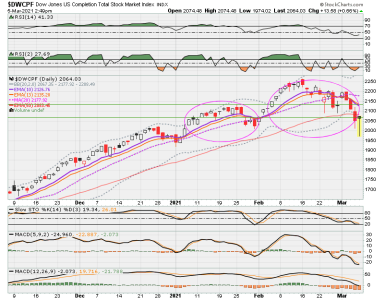

Sticky pants deployed, but not sure how much longer. Fed talks tomorrow. Still look to be in downtrend...I am not following my strategy...bad me!

Looking better now than it did this morning. Bollingers contracting. Stochastic still slightly pointed up. But 10 and 13 EMAs both below 20 SMA (mid-point of Bollinger bands).

Looking better now than it did this morning. Bollingers contracting. Stochastic still slightly pointed up. But 10 and 13 EMAs both below 20 SMA (mid-point of Bollinger bands).