DreamboatAnnie

TSP Legend

- Reaction score

- 854

The Forum works well on MOBILE devices without an app: Just go to: https://forum.tsptalk.com

Please read our AutoTracker policy on the

IFT deadline and remaining active. Thanks!

$ - Premium Service Content (Info) | AutoTracker Monthly Winners | Is Gmail et al, Blocking Our emails?

Find us on: Facebook & X | Posting Copyrighted Material

Join the TSP Talk AutoTracker: How to Get Started | Login | Main AutoTracker Page

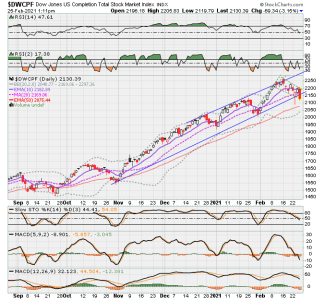

Hi FAAM, Blessings to you too! I think its very risky to buy-in before an upswing starts. I was waiting until tomorrow, but now that a fully engulfing red candle has formed, I am starting to doubt that I will enter. Of course, it is possible this could be the bottom due to severity of drop, just not sure. Stochastic has not gotten below 20 and started to swing back up, so will see when that happens---there could be further drops. Thought this might be a bull flag, but now its looking like a drop. The large engulfing candle has even broken below the mid-term trendline...not good.Thx for posting DBA! I hope you're right... I added to my modest TSP Equities position with IFT submission out of G today. Hoping it a down day good entry for a short cycle up; if that is a bull flag willing to bull-up; & position of/in B-bands seem reasonable per your chart - to my untrained eye. Blessings to you.

I was looking at some historical charts: the year post election and the regular February/March charts (I should have looked sooner) - all seemed to show last of Feb, often low and first three days of March fairly high. interestingly, in the post election chart for the year, the rest of March, April and May were low to flat trading with the big jump starting in June/July and extending the rest of the year.

I too am waiting for a good position to pull back and take stock - parden the pun.

Hi DreamboatAnnie, prayers to you and all your fellow Texans enduring the winter storm and power crisis. Praying for all the lives lost.

I have been a reader of tsptalk for 10+ years, never really posted anything. I don’t have anything informative to provide like everyone here. Every tsp move I’ve made for the last 18 yrs were from the gut, rumors, and CNBC. I finally crossed the 1mil milestone after 18 yrs and 3 mo.

I need to thank you and other contributors to this forum with the charts and technical analysis. After crossing the milestone I started to educate myself on how to read candlestick charts and the technical indicators. Funny, I used to ready Tom’s market commentary and stop when I get to the charts.

I also need to thank Coolhand and Bquat charts and analysis amongst others. I still have 8 yrs before retirement at 56 and look forwards to the next milestone.

Again, thank you and everyone for all you do.

Regards,

Radarcontact

Here is a very good link for learning more...

https://www.freeonlinetradingeducation.com/chart-school.html