Hi Flalaw97, Was not able to answer your question Friday as I was out of town. So, I am very glad that RF answered your question! Very good response.

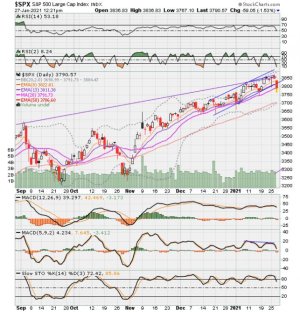

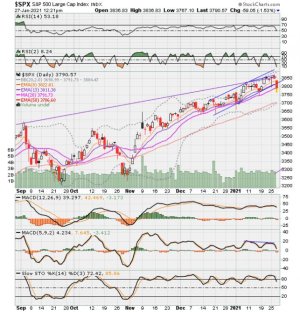

You asked if Stochastic is no longer embedded. Embedded is something Ira Epstein refers to in his teaching. He defines it as when both lines of Stochastic (K% and D%) are at or above 80 for 3 days. As soon as one line drops below 80, it is no longer embedded unless it re-embeds within one day/or other chart timeframe. The S and C fund have been embedded for quite some time. Both the S and C fund lost the embedded reading on Wednesday 1/27 by mid-day. See my posts 3301.

Regarding exits, its important to always have an exit plan, whether you’re a swing or longer-term trader. Some believe you should just stay in and ride a market drop down and back up since we are in a “bull” market. I am not of that opinion.

Market can drop 10% and still be considered a “normal” downturn by pros, and overall market’s not considered to enter a Bear market until it drops 20%+. That doesn’t happen in a few days…or at least it hasn’t. With increased rapid transaction trading and more individuals trading, I think that remains to be seen.

My 2021 Strategy is to TRY to make sure I have fully exited when the daily 13 EMA drops below the daily 20 SMA (also shown as Mid-point of Bollinger band=dotted pink line between upper and lower dotted gray bands on my charts). However, if you wait that long, you may LOSE quite a bit IF you did not enter the buy when the 13 EMA crossed above the 20 MA the last time it occurred. So, that is why you will see that I usually start to reduce exposure before that point (to pocket some gains)…plus fear has stopped me from entering when 13 EMA first crosses over 20 SMA. This bearish crossover occurred on Friday for both C and S funds. So, if I had still been in market that would be a firm exit for me under my current strategy.

I start to REDUCE exposure when I see trendline formations that are bearish (e.g. rising bearish wedge that formed over the past week or so), or bearish candlesticks/or formations COUPLED with Stochastic K% line (black) crossing below the 80 line (losing embedded reading), or MACD crossing below its signal line or bearish divergence forming (in price candlesticks in comparison to Stochastics, MACD, RSI or VIX).

The divergences are something I just recently started observing more frequently. On 19th I exited 80% due to RSI dropping below 70 And MACD starting to cross below its signal line.

I exited my remaining 20% on that date. See my post 3300 where I mention the bearish wedge formation and marked the divergence on charts. Notice that the Stochastics were still embedded at that point (see numbers on Stochastics part of the charts...all above 80.) But by post 3301, charts two days later, the Stochastics no longer embedded due to market drop.