DreamboatAnnie

TSP Legend

- Reaction score

- 912

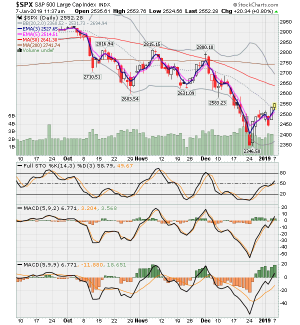

EXITED---100G ... I scream uncle! :sucks: Would like to just stop investing at this point. I lost 8% at start of the year, worked to gain it back only to lose it again during past two weeks. Yes.... I kept thinking it would turn around and did NOT follow my strategy. Got over confident with the good entry exits that I did in Oct and Nov.

Oh well.... It is Christmas Eve and I am glad to be spending it with family and friends! :nuts: So it now time to look ahead, like water off the back of a duck... and I am ready for the work ahead to try to get it all back in 2019 plus some.

Best Wishes to You all !!!!!!!! :smile:

Oh well.... It is Christmas Eve and I am glad to be spending it with family and friends! :nuts: So it now time to look ahead, like water off the back of a duck... and I am ready for the work ahead to try to get it all back in 2019 plus some.

Best Wishes to You all !!!!!!!! :smile: