Decision made to reduce exposure to 50% C fund with rest in G fund.

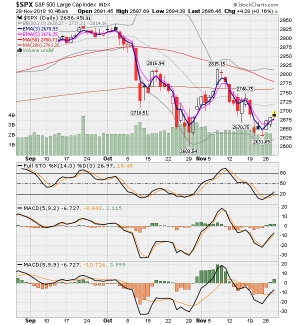

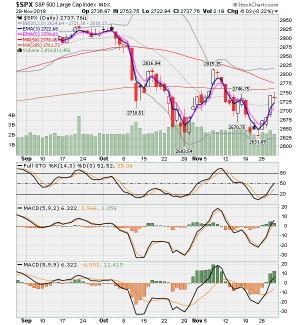

Hoping for a neutral to up day. So doing this means I meet my goal of only being invested 50% going into December. While I think we will get some positive news out of the G20, I prefer to not count on it. The MACD (5,9,2) is headed upward but I can also see that the momentum is slowing (see MACD histogram bars). That is the same for both S and C fund. Obviously this does not predict the future, but we getting closer to being over bought (reaching 80 on Stochastic). I wanted to reduce exposure yesterday only because I thought many would want to book some gains today and that could still occur as a fade towards end of day, but I just want to keep myself in a position to not be fully invested until we clearly are out of the downtrend. The mid-point on Bollinger bands is a great confidence builder and indicates to me that this could be the case. Will see...

Best Wishes to you on Your Investments and Wishing you all a GREAT Weekend!!!!!!!! :smile: