Downside action just can't get any traction. Today, the market managed to eke out some modest gains overall, but volume is very light and that's become a trend all by itself. Volume on the NYSE was barely 640 million shares and that ain't much.

I believe liquidity has been largely moving this market and it remains a formidable barrier to the bear's attempts to take this market down. Until that liquidity drops off, price will probably continue to rise. And it's anyone's guess when that might happen.

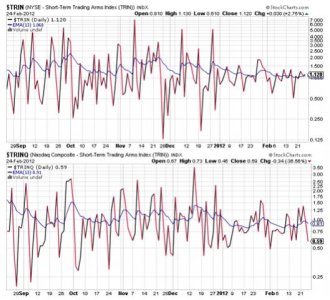

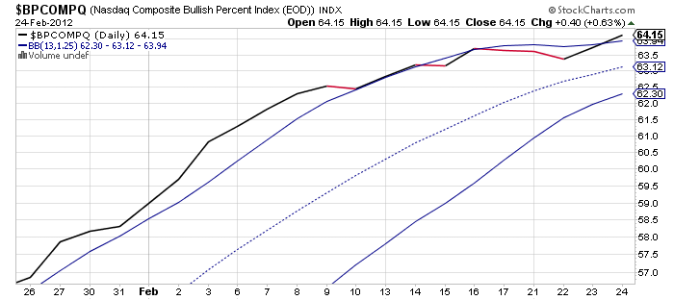

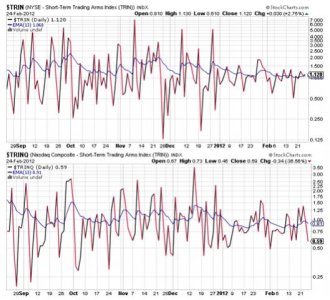

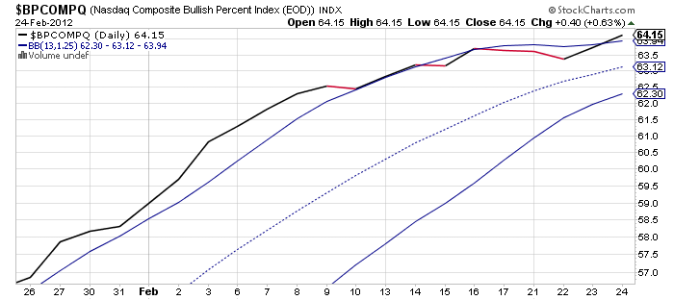

I've got a bit more time this evening, so I'll post the charts:

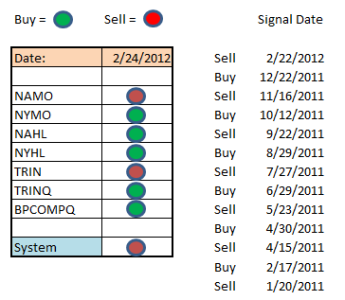

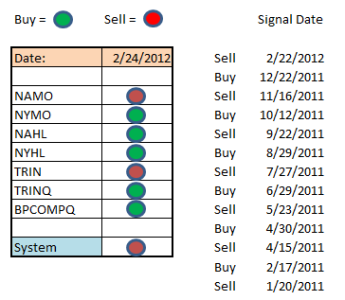

It's a mixed bag of buys and sells and none of these signals are robust. But the Seven Sentinels remain in a sell condition until all seven signals move back to a buy condition simultaneously. And that may happen if we get another pop higher early next week.

Stop by Sunday evening and I'll have the tracker charts posted.

I believe liquidity has been largely moving this market and it remains a formidable barrier to the bear's attempts to take this market down. Until that liquidity drops off, price will probably continue to rise. And it's anyone's guess when that might happen.

I've got a bit more time this evening, so I'll post the charts:

It's a mixed bag of buys and sells and none of these signals are robust. But the Seven Sentinels remain in a sell condition until all seven signals move back to a buy condition simultaneously. And that may happen if we get another pop higher early next week.

Stop by Sunday evening and I'll have the tracker charts posted.