Another choppy day, but in keeping with the Monday trend it was up at the close. And as a result the DOW passed and held the magical 11,000 mark.

The market continues to focus on the Greece bailout and its implications on the EU in general. I don't think this story will go away anytime soon. Even after the Greece situation is stabilized, there are other countries in economic straits waiting for their moment in the economic sun.

The dollar was down modestly today, but more notably the VIX continues to drop. Today it closed at 15.58, which is its lowest close since June of 2007. Investors believe that a high value of VIX translates into a greater degree of market uncertainty, while a low value of VIX is consistent with greater stability. Greater stability also translates into more complacency, which can lead to a market correction. But I'm not suggesting we're about to correct. At least not just yet.

Still neutral overall and still on a buy.

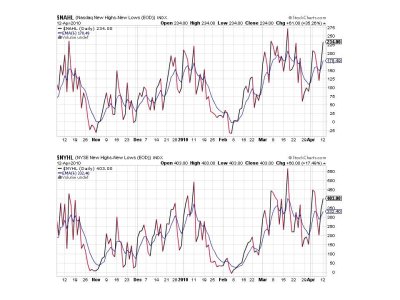

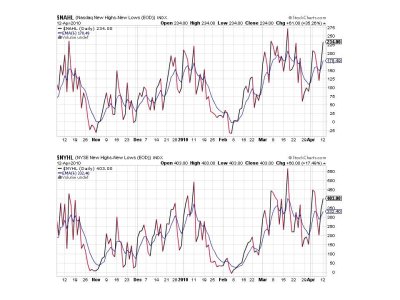

We can tell the market hit new highs today as both NAHL and NYHL stretched it out to the upside.

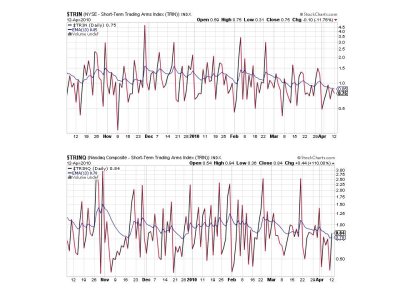

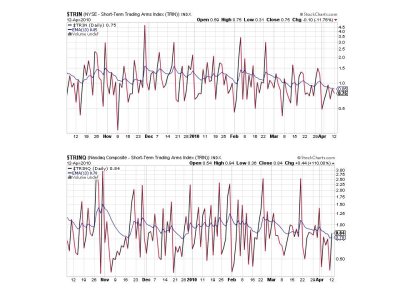

TRIN is on a buy while TRINQ flipped to a sell. I had expected to see some selling today based on the low TRINQ reading from Friday, but such was not the case.

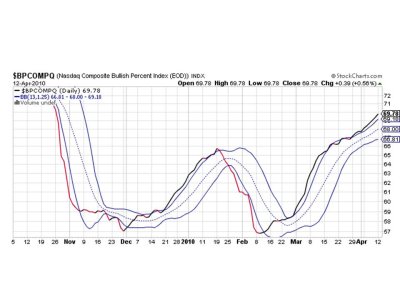

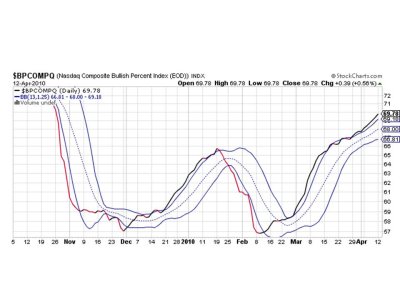

This trend signals continues to more higher. It's very close to 70, which is where the NASDAQ begins to be considered overbought. But that is not an indication of impending selling by itself.

So we have 6 of 7 signals on a buy, which keeps the system on a buy. This market just doesn't seem to want to sell off and picking a top has certainly been folly for quite some time now. There's still plenty of reasons to be bearish, which may very well keep a bid under this market. And the Seven Sentinels continue to appear bullish. With NAMO and NYMO in neutral territory and BPCOMPQ still rising, it's hard to get bearish and in fact we seem to be setting up for another big push higher. But I'll let the market decide if that's the case or not.

That's it for this evening. See you tomorrow.

The market continues to focus on the Greece bailout and its implications on the EU in general. I don't think this story will go away anytime soon. Even after the Greece situation is stabilized, there are other countries in economic straits waiting for their moment in the economic sun.

The dollar was down modestly today, but more notably the VIX continues to drop. Today it closed at 15.58, which is its lowest close since June of 2007. Investors believe that a high value of VIX translates into a greater degree of market uncertainty, while a low value of VIX is consistent with greater stability. Greater stability also translates into more complacency, which can lead to a market correction. But I'm not suggesting we're about to correct. At least not just yet.

Still neutral overall and still on a buy.

We can tell the market hit new highs today as both NAHL and NYHL stretched it out to the upside.

TRIN is on a buy while TRINQ flipped to a sell. I had expected to see some selling today based on the low TRINQ reading from Friday, but such was not the case.

This trend signals continues to more higher. It's very close to 70, which is where the NASDAQ begins to be considered overbought. But that is not an indication of impending selling by itself.

So we have 6 of 7 signals on a buy, which keeps the system on a buy. This market just doesn't seem to want to sell off and picking a top has certainly been folly for quite some time now. There's still plenty of reasons to be bearish, which may very well keep a bid under this market. And the Seven Sentinels continue to appear bullish. With NAMO and NYMO in neutral territory and BPCOMPQ still rising, it's hard to get bearish and in fact we seem to be setting up for another big push higher. But I'll let the market decide if that's the case or not.

That's it for this evening. See you tomorrow.