The Seven Sentinels continue to show Intermediate Term weakness in the charts, but this being Post OPEX it is very reasonable to assume some measure of rally by the end of the week. But if the bulls don't put a better fight than what we saw this morning, it could be a long week for them.

Short term the indicators imply some strength building, but how much remains to be seen. Regardless of any strength, the trend is still down and that's something I remain very mindful of.

Here's the charts:

A little more weakness, but a bounce looks likely.

NAHL and NYHL show some positive divergences (short term), which should translate into a rally of some measure.

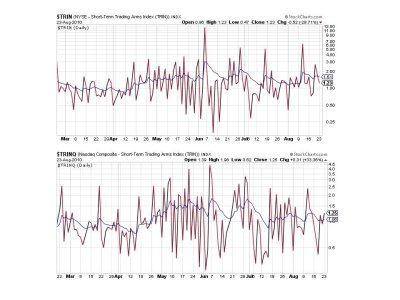

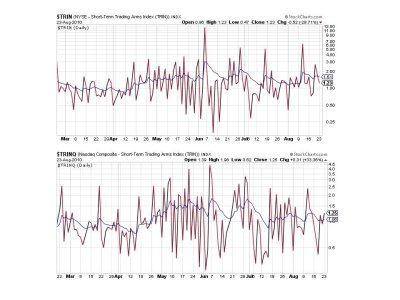

TRIN and TRINQ remain relatively neutral.

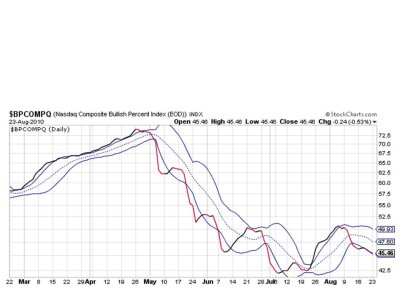

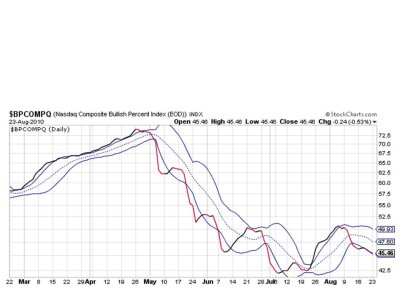

BPCOMPQ continues to ebb lower and remains on a sell.

So the Sentinels remain on an Intermediate Term sell, but we should see some buying pressure at some point this week, but I seriously doubt it will be enough to challenge the current sell signal. I remain 100% G fund.

Short term the indicators imply some strength building, but how much remains to be seen. Regardless of any strength, the trend is still down and that's something I remain very mindful of.

Here's the charts:

A little more weakness, but a bounce looks likely.

NAHL and NYHL show some positive divergences (short term), which should translate into a rally of some measure.

TRIN and TRINQ remain relatively neutral.

BPCOMPQ continues to ebb lower and remains on a sell.

So the Sentinels remain on an Intermediate Term sell, but we should see some buying pressure at some point this week, but I seriously doubt it will be enough to challenge the current sell signal. I remain 100% G fund.