...it's almost May, the major averages are overbought, the dollar is getting hammered, and sentiment is getting a little bit frothy on the bullish side as this market continues its current up-leg. But does any of that matter when the punch bowl is still flowing?

On the data front, an advance reading of the first quarter GDP showed the economy grew at an annualized rate of 1.8%, which beat the 1.7% estimate economists were looking for.

But initial claims disappointed. They totaled 429,000, which was a rather big jump from the anticipated 390,000 that was forecast. That 400,000 level is significant too, and may become a bigger issue if it doesn't stabilize soon.

Among the companies that reported earnings today are the following:

Akamai Tech (AKAM 34.94, -6.04), Norfolk Southern (NSC 73.87, +5.46), Exxon Mobil (XOM 87.34, -0.44), Procter & Gamble (PG 64.50, +0.48), PepsiCo (PEP 69.72, +1.79), eBay (EBAY 34.00, -0.03), Colgate-Palmolive (CL 82.97, +1.91), AstraZeneca (AZN 49.90, -1.72), BristolMyersSquibb (BMY 28.29, +0.01), and Aetna (AET 41.45, +1.64).

Here's today's charts:

Higher still for NAMO and NYMO, which doesn't surprise me, but notice NYMO passed the 40 level today and that means downside risk may be rising.

NAHL and NYHL remain on buys.

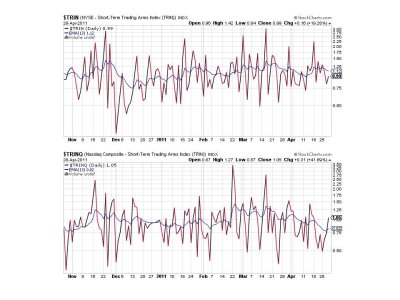

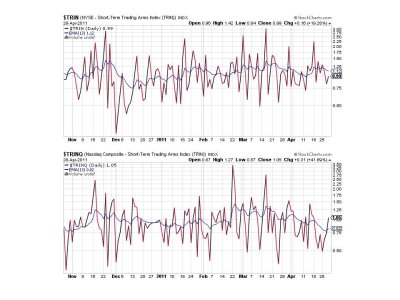

TRIN is still flashing a buy, but TRINQ probed deeper into sell territory, but it's still not an extreme reading.

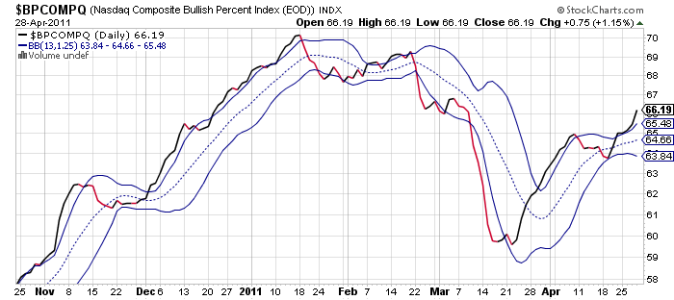

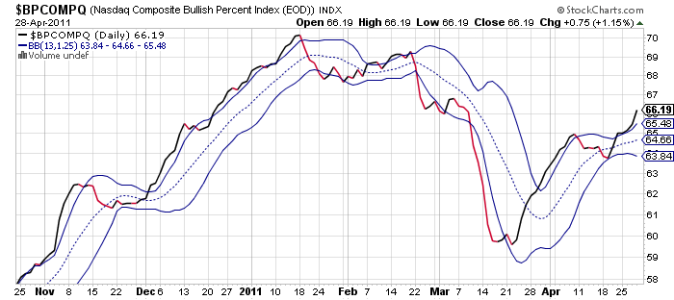

BPCOMPQ is really looking bullish right now. It's getting more vertical, and that's usually a sign we're going higher. But is it enough? And what about that gap on the S&P? It's now as much as about 47 points below from where we closed today.

It's certainly possible that the upside will continue to surprise traders. Or we could simply level off some and work off this overbought condition. But that gap is going to continue to beckon.

On the data front, an advance reading of the first quarter GDP showed the economy grew at an annualized rate of 1.8%, which beat the 1.7% estimate economists were looking for.

But initial claims disappointed. They totaled 429,000, which was a rather big jump from the anticipated 390,000 that was forecast. That 400,000 level is significant too, and may become a bigger issue if it doesn't stabilize soon.

Among the companies that reported earnings today are the following:

Akamai Tech (AKAM 34.94, -6.04), Norfolk Southern (NSC 73.87, +5.46), Exxon Mobil (XOM 87.34, -0.44), Procter & Gamble (PG 64.50, +0.48), PepsiCo (PEP 69.72, +1.79), eBay (EBAY 34.00, -0.03), Colgate-Palmolive (CL 82.97, +1.91), AstraZeneca (AZN 49.90, -1.72), BristolMyersSquibb (BMY 28.29, +0.01), and Aetna (AET 41.45, +1.64).

Here's today's charts:

Higher still for NAMO and NYMO, which doesn't surprise me, but notice NYMO passed the 40 level today and that means downside risk may be rising.

NAHL and NYHL remain on buys.

TRIN is still flashing a buy, but TRINQ probed deeper into sell territory, but it's still not an extreme reading.

BPCOMPQ is really looking bullish right now. It's getting more vertical, and that's usually a sign we're going higher. But is it enough? And what about that gap on the S&P? It's now as much as about 47 points below from where we closed today.

It's certainly possible that the upside will continue to surprise traders. Or we could simply level off some and work off this overbought condition. But that gap is going to continue to beckon.