As if on cue after a short bout of weakness, the dip buyers stepped back in and helped the major averages post modest to moderate gains. This in spite of another rally in the dollar, which saw the greenback hit its high of about 0.9% at its peak, but settle back down to a more modest 0.3% advance at the close.

Bonds were under pressure again today, but also managed to stage a comeback later in the session. The 30-year Note's yield was as high as 4.33% before closing around 4.24%. Similar action was seen in shorter term securities as well as our F fund.

Initial jobless claims came in at 435,000, which was less than the expected 450,000. Continuing claims also fell as the number came in at 4.30 million.

Tomorrow is Veteran's Day, but the stock market will remain open. The bond market will be closed however.

The action so far is not particularly bearish. In fact, it looks like a healthy pullback after last week's run. I am still looking to redeploy some capital at this point. Unfortunately, IFTs cannot be executed tomorrow, which means Friday is the earliest day to realign allocations.

Here's today's charts:

NAMO and NYMO snapped back a bit today. One is neutral while the other remains on a sell.

Internals did not fare well. NAHL and NYHL actually fell. But in this bullish environment this is not too concerning at this point. They both remain on sells.

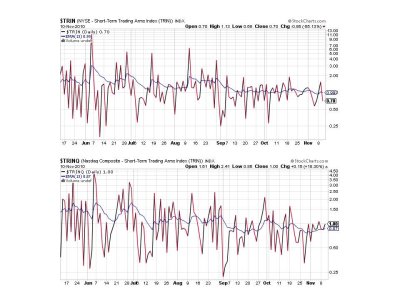

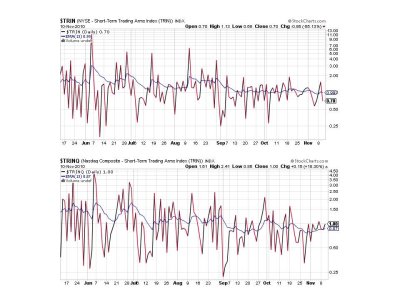

TRIN flipped back to a buy, while TRINQ remained on a sell.

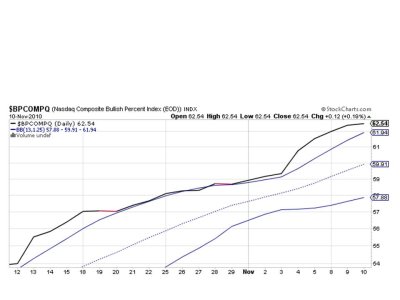

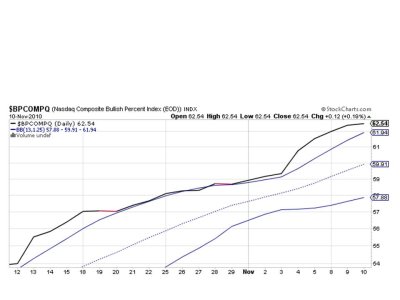

BPCOMPQ looks to be leveling off a bit, but is still a solid buy.

So the Sentinels remain on a buy and as I mentioned above the action still looks bullish longer term. My expectation for a pullback has already been met this week, with the G20 summit kicking off tomorrow. I expect higher prices down the road, but the weakness we've seen thus far may not be over before we resume a sustained move higher.

Bonds were under pressure again today, but also managed to stage a comeback later in the session. The 30-year Note's yield was as high as 4.33% before closing around 4.24%. Similar action was seen in shorter term securities as well as our F fund.

Initial jobless claims came in at 435,000, which was less than the expected 450,000. Continuing claims also fell as the number came in at 4.30 million.

Tomorrow is Veteran's Day, but the stock market will remain open. The bond market will be closed however.

The action so far is not particularly bearish. In fact, it looks like a healthy pullback after last week's run. I am still looking to redeploy some capital at this point. Unfortunately, IFTs cannot be executed tomorrow, which means Friday is the earliest day to realign allocations.

Here's today's charts:

NAMO and NYMO snapped back a bit today. One is neutral while the other remains on a sell.

Internals did not fare well. NAHL and NYHL actually fell. But in this bullish environment this is not too concerning at this point. They both remain on sells.

TRIN flipped back to a buy, while TRINQ remained on a sell.

BPCOMPQ looks to be leveling off a bit, but is still a solid buy.

So the Sentinels remain on a buy and as I mentioned above the action still looks bullish longer term. My expectation for a pullback has already been met this week, with the G20 summit kicking off tomorrow. I expect higher prices down the road, but the weakness we've seen thus far may not be over before we resume a sustained move higher.