It appeared early in the trading day that we were in for some follow-though selling pressure after yesterday's weak close and we got that. But the lows of the day were in well before noon EST and it was grind higher from there into a positive close. While this was certainly a bullish sign, the S&P 500 was still not able to close above 1300, which bears will want to point out as evidence we'll be heading lower.

Perhaps, but I'm still of the opinion that liquidity will prevail at some point.

There wasn't much on the economic front, but we did get February's new home sales numbers, which dropped 17% to an annualized rate of 250,000. This is a record low and certainly caught analysts by surprise.

Here's today's charts:

NAMO and NYMO remain on buys and did tick a bit higher today.

NAHL and NYHL weakened a little, but also remain on buys.

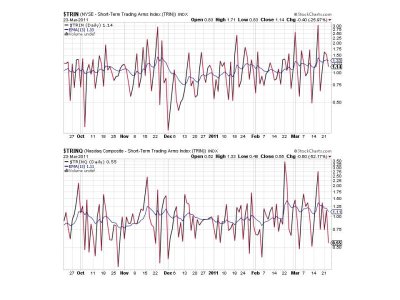

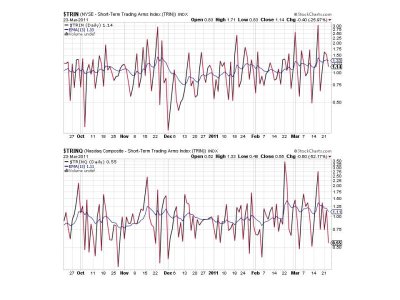

Both TRIN and TRINQ are flashing buys, but TRINQ is suggesting a relatively modest overbought condition, which could mean a bit more weakness may be headed our way in the short term.

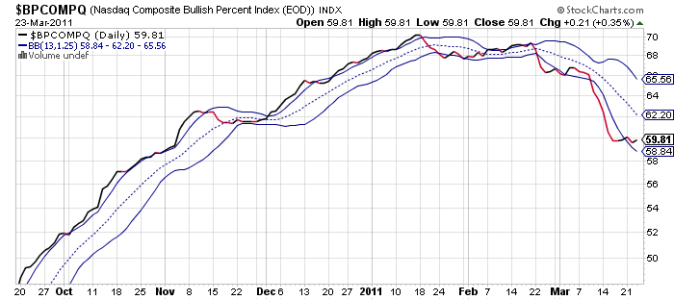

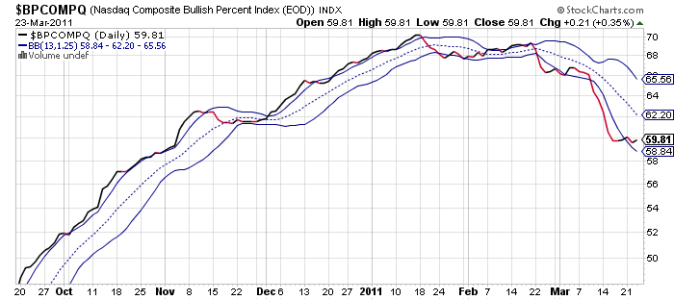

BPCOMPQ turned up on today's action and also remains on a buy.

So that means all Seven Signals are flashing buy signals today, which means we have an unconfirmed buy signal for the system. The only thing missing to confirm this signal is a 28 day trading high from NYMO. And NYMO is still more than 30 points away from that, but there's a very real chance it could happen in this volatile market. Especially if the market coils below S&P 1300 for a thrust higher at some point over the next few trading days.

While I remain hedged with 50% of my position in the G fund, if I had another IFT I would be looking for another dip to bump up my stock exposure, because while I was already leaning bullish this unconfirmed buy signal only makes me more convinced we're heading higher in the days ahead.

Perhaps, but I'm still of the opinion that liquidity will prevail at some point.

There wasn't much on the economic front, but we did get February's new home sales numbers, which dropped 17% to an annualized rate of 250,000. This is a record low and certainly caught analysts by surprise.

Here's today's charts:

NAMO and NYMO remain on buys and did tick a bit higher today.

NAHL and NYHL weakened a little, but also remain on buys.

Both TRIN and TRINQ are flashing buys, but TRINQ is suggesting a relatively modest overbought condition, which could mean a bit more weakness may be headed our way in the short term.

BPCOMPQ turned up on today's action and also remains on a buy.

So that means all Seven Signals are flashing buy signals today, which means we have an unconfirmed buy signal for the system. The only thing missing to confirm this signal is a 28 day trading high from NYMO. And NYMO is still more than 30 points away from that, but there's a very real chance it could happen in this volatile market. Especially if the market coils below S&P 1300 for a thrust higher at some point over the next few trading days.

While I remain hedged with 50% of my position in the G fund, if I had another IFT I would be looking for another dip to bump up my stock exposure, because while I was already leaning bullish this unconfirmed buy signal only makes me more convinced we're heading higher in the days ahead.