For the first hour of the morning session it looked as if the stock market might be in for a good pull back. But the dip buyers were waiting in the wings to ambush the bears and that's largely how it played out as the broader market ended mostly higher by the close.

It would seem the market is now poised to make a move in one direction or the other over the next two trading days. In that time we'll get the European Central Bank's monetary policy statement and know the outcome of a the eurozone summit. And the pressure is on for EU officials as we're now seeing regular credit downgrade threats hitting the wires. The fact that our Treasury Secretary is making a high profile appearance over there pretty much sums up just how much of threat a non agreement would be for the US too.

There wasn't much else new for the day so let's go right into the charts:

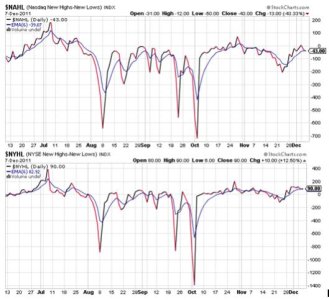

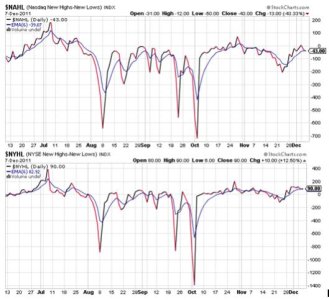

Momentum has turned down a bit, but both NAMO and NYMO remain on buys.

NAHL flipped to a sell today, albeit barely, while NYHL ebbed just a tad higher and retained its buy status.

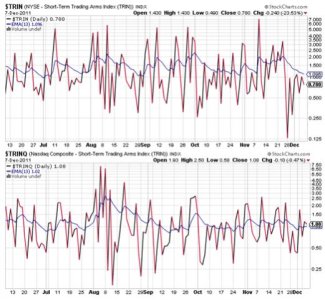

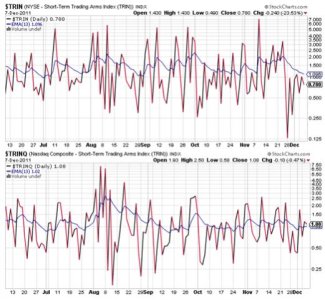

TRIN and TRINQ both remain where they were yesterday. On a buy and sell respectively, but very neutral overall.

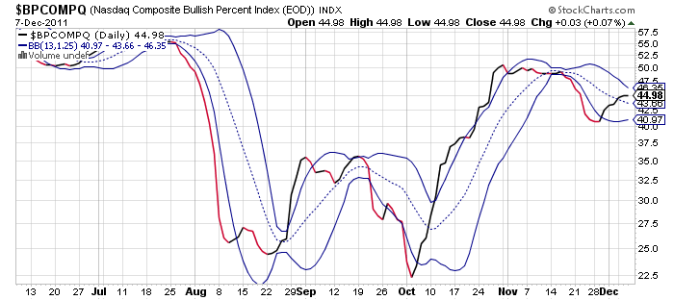

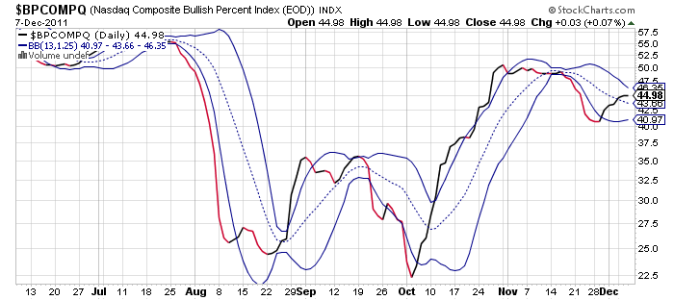

BPCOMPQ is tracking sideways and that has me wondering which way its going to move when this market finally gets out of neutral.

It does remain on a buy.

So the signals are mixed with perhaps a modest bullish bias. The system remains in a sell condition though, but the 28 day trading high for NYMO to confirm those unconfirmed buy signals is dropping. NYMO only needs to get above a 44 now to confirm a buy signal. It's only about 25 points away, so it could conceivably hit that mark should this market take off to the upside in the next couple of days.

And the ECM policy statement and EU Summit could be the catalysts. Of course that's assuming the market likes what it hears. Otherwise we'll probably be headed the other way (down), but given seasonality that may not last either.

I'm still standing by in the G fund should lower prices present themselves. My expectation is still one of lower first, then higher. But the market doesn't take its cues from me, so we'll see how it plays out very soon.

It would seem the market is now poised to make a move in one direction or the other over the next two trading days. In that time we'll get the European Central Bank's monetary policy statement and know the outcome of a the eurozone summit. And the pressure is on for EU officials as we're now seeing regular credit downgrade threats hitting the wires. The fact that our Treasury Secretary is making a high profile appearance over there pretty much sums up just how much of threat a non agreement would be for the US too.

There wasn't much else new for the day so let's go right into the charts:

Momentum has turned down a bit, but both NAMO and NYMO remain on buys.

NAHL flipped to a sell today, albeit barely, while NYHL ebbed just a tad higher and retained its buy status.

TRIN and TRINQ both remain where they were yesterday. On a buy and sell respectively, but very neutral overall.

BPCOMPQ is tracking sideways and that has me wondering which way its going to move when this market finally gets out of neutral.

It does remain on a buy.

So the signals are mixed with perhaps a modest bullish bias. The system remains in a sell condition though, but the 28 day trading high for NYMO to confirm those unconfirmed buy signals is dropping. NYMO only needs to get above a 44 now to confirm a buy signal. It's only about 25 points away, so it could conceivably hit that mark should this market take off to the upside in the next couple of days.

And the ECM policy statement and EU Summit could be the catalysts. Of course that's assuming the market likes what it hears. Otherwise we'll probably be headed the other way (down), but given seasonality that may not last either.

I'm still standing by in the G fund should lower prices present themselves. My expectation is still one of lower first, then higher. But the market doesn't take its cues from me, so we'll see how it plays out very soon.