Trading started out ugly and small wonder too. With the market already reeling from non-progress in the debt ceiling negotiations, we got a negative revision to the Q1 GDP and then followed that up with a weak Q2 GDP number. In addition, consumer sentiment dipped, but the Chicago PMI number was healthy.

But the tone was set early on. At one point the S&P 500 got close to its 200 day moving average very early in the trading session, but that support held. A technical plus! From there the major averages chopped their way higher as dip buyers stepped back in after some headlines hit the newswires suggesting a larger contingent of GOP representatives were supporting the House bill. And just after 1100 EST the S&P 500 actually went positive. The rise in the Wilshire 4500 was even more impressive as it was about twice as negative as the S&P 500 at almost a 2% loss. It too went positive around the same time. But the major averages couldn't hold those gains as they fell back below the neutral line where they traded with modest losses for much of the remaining session before dipping lower at the end of the day and closing with modest to moderate losses across the board.

If Washington could have come to an agreement before the closing bell the market might have rallied much more than it did. But anxiety is still running high without that elusive deal and few want to hold over the weekend while the debt ceiling debate continues. After all, we're on the cusp of financial Armageddon, right? :blink:

Let's take a look at the charts:

NAMO has moderated over the past two trading days, but NYMO has continued its downward trajectory. Both remain in sell conditions.

NAHL and NYHL both remain on sells too.

TRIN just did cross back up through its 6 day EMA, which flips it to a sell condition, while TRINQ remains on a sell.

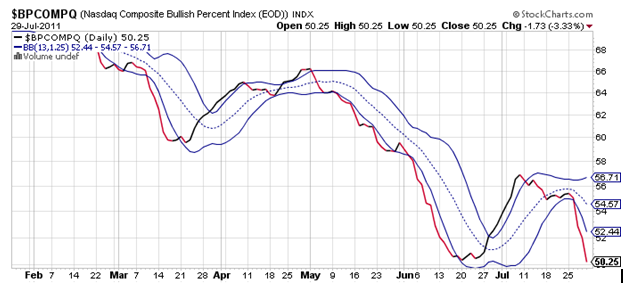

BPCOMPQ continued to drop and does not look good. It remains in a sell condition.

So all signals are back to sell conditions, which keeps the system in an intermediate term sell condition.

If I didn't think the pols in Washington would get a deal done before August 2nd, I'd be concerned. BPCOMPQ alone looks very bearish, but this market is ripe for another launch off technical lows such as NAMO/NYMO, and we also have another hold (buy) signal from our sentiment survey and many other polls are showing increased bearishness. I have to say the media is doing a fine job of stirring up negative emotion as are our elected officials.

So it'll be interesting to see if a deal gets done over the weekend. I think the tone of trading for Monday hinges on it.

Check back Sunday evening for the latest Tracker Charts. See you then.