Update: I ran the math wrong earlier-I would owe approximately 2K more next year in fed tax, not 1500 less. Maybe I'll bump up my charitable contributions even further next year, at least I'll know where the money is going. and pay a little less in fed tax. makes it harder to save for business startup in a couple years, even if I can do full deduct for expenses in a given year. Got to fork out the funds for the expenses first before can deduct them.

I want to avoid using OPM for startup funds. Would like to not worry about loan repayments until I know I'm turning a profit, not pay interest on top of not having a net profit right away. For me, it's all about having initial savings for startup capital, and then managing cash flow. I never took any business classes, never had any interest until I started looking into what I might do in retirement to be productive, stay interested by developing current hobby interests into small biz and desired retirement lifestyle. now I'm learning biz development by bootstrap, similar to how I've learned other things over the years, as needed. :laugh:

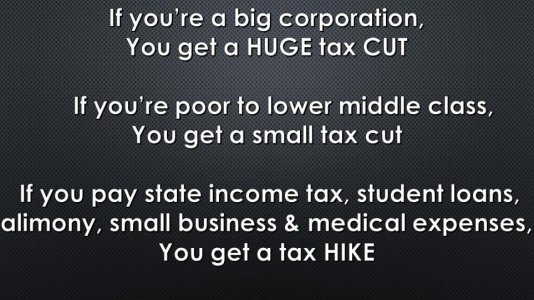

There are other interesting items in the tax bill, at least of interest to me. won't point out all the ones of interest to me but there are some of general interest perhaps.

Think really hard about divorce, if you would be the one paying alimony. You will be paying the taxes on the alimony payment. The ex would not be paying them.

Think hard about bouncing around to new job every couple years or otherwise exchanging primary residences. No more cap gains exemption unless stay in same primary residence 5 of past 8 years.

Make suuure you get a written receipt signed and dated, for every charitable donation valued at $250 or more.

https://www.scribd.com/document/363314543/Tax-Cuts-and-Jobs-Act-Section-by-Section#from_embed